Oyeindiepreye Olorogun, a Lagos-based civil servant, has detailed how N144,000 was fraudulently withdrawn from her United Bank for Africa (UBA) account by unknown persons.

Olorogun, speaking with FIJ, stated that her account was emptied by fraudsters who accessed it without her consent on April 30.

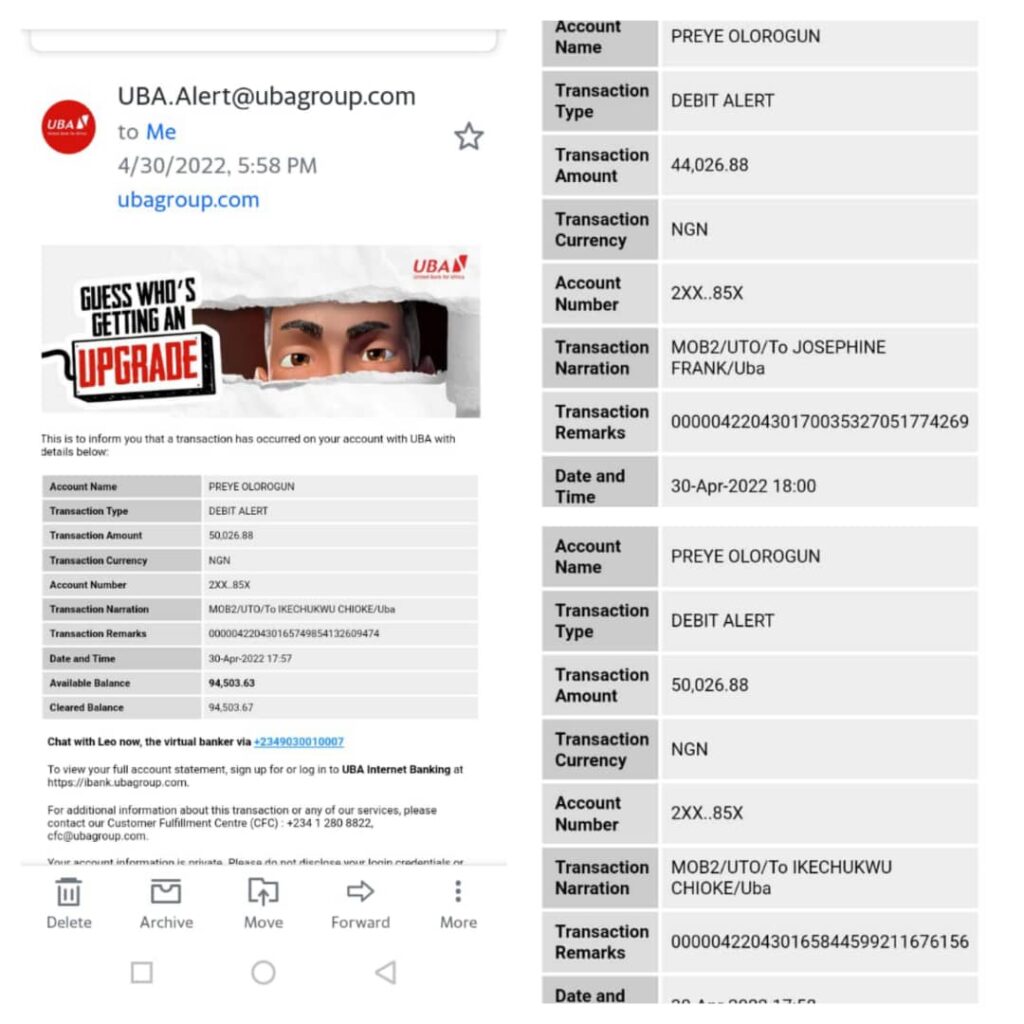

“I was home in the evening that Saturday when I got a notification at 5:57 pm that N50,000 had left my account. The money was sent into an account owned by one Ikechukwu Chikoke,” Olorogun told FIJ.

READ ALSO: UBA ‘Blames’ Doctor Whose N377,000 Was Fraudulently Deducted

“The next minute, I received another debit alert of N50,000 transferred to the same person. While I was still trying to understand the situation, the last debit alert, a N44,000, came in. This time, it was transferred to Josephine Frank.”

The civil servant said she immediately reached out to her bank to complain but there was no response to her inquiries.

“I immediately put a call through to UBA’s customer care but there was no response. I also sent them an email before blocking my account,” he said.

“When they responded after three days, they said they would commence investigations. I told them all I wanted was for them to reverse the transaction because I did not authorise it. But they never responded to the email.”

Olorogun told FIJ that when she visited a branch of the bank in January, she was told that the issue would take 180 days to resolve.

“Early this year, I visited a branch at PWD, Air Force Base, Ikeja, and explained to the customer care representative the issue I had. The agent then told me it would take 180 days to resolve the issue,” he said.

“When I told him that it had been over 180 days already and that I needed my money, he said they were monitoring the accounts that received my money and that they would withdraw and forward to me any money that entered the account.

“He also said that what I would get might not be up to the amount lost. This is another April, and it will be one year soon, but there is no hope in sight. I need UBA to be accountable for my money; it is my sweat and blood.”

READ ALSO: UBA Says N65,000 Fraudulently Deducted From Customer’s Account ‘Is Difficult to Trace’

When FIJ sent an email to Nasir Ramon, UBA’s public relations officer, inquiring about the fraudulent transaction on Olorogun’s account, the bank stated that the customer had compromised her details, and so it was not liable for the loss.

“The fact that the customer’s account was used to enroll on the UBA mobile banking platform via her sensitive account details shows that her details were compromised in addition to the verification code delivered to the registered mobile line,” the bank wrote.

“United Bank for Africa was not negligent. The successful enrollment on the UBA Mobile Banking platform and the resulting unauthorized transactions were possible due to the compromise of her sensitive account details and the verification code delivered to the registered mobile line. Hence, the request for a refund was declined.”

Olorogun, however, insisted she never compromised her details and was home when the incident happened.

Subscribe

Be the first to receive special investigative reports and features in your inbox.