Ojinmah Chinwendu Iynda, a Nigerian entrepreneur, has narrated how ₦390,000 disappeared from her Zenith Bank while initially thinking because she does not use an ATM card or personal identification number (PIN) her account could not have been compromised.

However, the bank’s investigations showed a friend of hers was among the perpetrators of the fraud that happened on her account.

IYNDA’S NARRATION

Iynda, who resides in Lagos State, told FIJ on December 18 that she became aware of the disappearance on December 5, when she wanted to carry out a transaction.

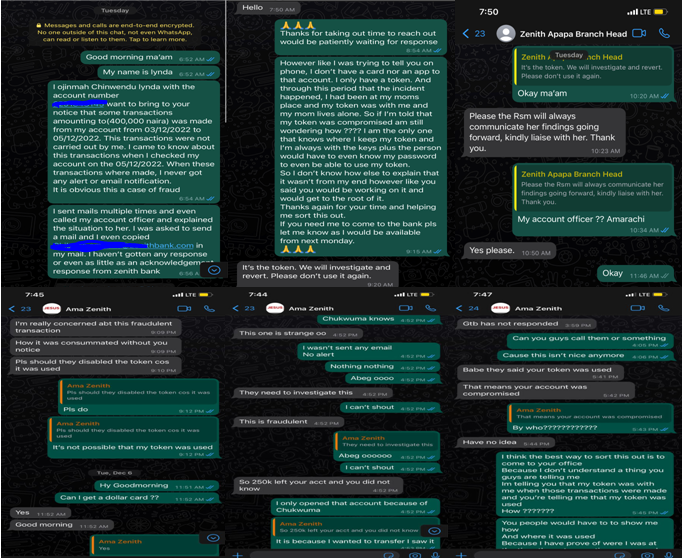

She said she immediately contacted her account officer, Amarachi Adelodun, to file a complaint and recover her money.

She said her complaint passed through Adelodun, Oguh, Apapa branch head; Zenith Bank’s fraud desk and other official channels but nothing happened.

“When I wanted to do a transaction on December 3, I shockingly saw that my money fell short of ₦390,000. Having observed this questionable event, my first point of communication was my account officer,” Iyanda told FIJ.

She explained that her communication with Adelodun led her to reach out to Oguh, who was said to be in a better position to resolve the issue.

“I explained the scenario to Adelodun, my account officer, and she asked me a series of questions to determine if I had knowledge of the unauthorised transactions. I told her I never approved such transactions,” she said.

“Moreover, since I created the account, I have never obtained an ATM card, and I do not use a PIN. I also do not link the account to their mobile app.

“I only restrict my transactions on the account to internet banking and I cannot finalise a transaction without a ‘token’. It is now very surprising and indeed questionable how such a huge amount would leave my account without my knowledge.

“The account officer said the fraudster took the money via internet banking but she couldn’t tell me how it was possible to authenticate the process without sending a ‘token’ to my registered line.

“I also need to add that my phone has always been with me. In fact, I was at my mother’s residence when this event happened. It was only myself and my mother that were in her house; no third person was with us.

“As far as I know, I did not at any point compromise my account information. I really want the bank to tell me how my account security was compromised.

READ ALSO: After FIJ’s Story, Zenith Bank, Parkway ReadyCash Refund Customer’s N30,000

“I never knew a day like this would come, when a substantial part of my business money would vanish from my account, an otherwise reliable place to keep money.”

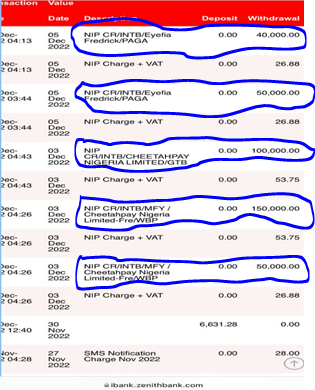

IYNDA’S MOBILE APP TRANSACTION HISTORY

According to the information shown on her mobile app, the fraud was done in piecemeal. The total amount was deposited into Wema Bank and Palmpay accounts.

On December 3, N300,000 was sent to Cheetahpay Nigeria Ltd’s GTBank account. Evidence also shows that one Eyefia Fredrick was a recipient of N90,000.

FIJ also found that Cheetahpay is a financial and communications solution company in Lagos State.

ZENITH BANK’S EARLIER RESPONSE

Asked whether the bank had responded to her emails, Iynda answered in the negative.

READ ALSO: N200,000 Disappears From Businessman’s 3-Month-Old Zenith Bank Account

“It is sad that the bank did not see it worthy to respond to my emails. I am disappointed that not even as little as an acknowledgement was sent to me after sending emails multiple times,” she said.

“Adelodun agreed with me that the manner in which the money left my account was fraudulent and then advised me to email their fraud desk. She also directed me to chat with Oguh.

“While chatting with my account officer, I told her I suspected this to be an inside action.

“I chatted with Oguh on WhatsApp and she later called me on phone so that they would investigate the circumstances surrounding this issue. She told me the person used my ‘token’.

“How could that be possible? I need an explanation. My phone has always been with me. On the said days, my phone was with me and I am sure no intruder took my phone.”

The bank failed to provide information requested by FIJ on Sunday. Rather, they asked this reporter to advise Iyanda to reach out for help.

REPORT OF THE BANK’S LATEST INVESTIGATION

In its latest response to the fraud, the bank’s findings showed that Iynda’s confidential banking information was actually jeopardised.

According to the report, three accounts were shown as the principal beneficiaries of the funds, the first among them belonging to Iyanda’s longtime friend.

Seeing the name of her friend prominently featuring on the report, Iynda was befuddled and felt completely betrayed that someone she regarded as a trusted friend could harm her in such manner.

“I am taken aback. I could not believe my eyes when I saw my friend’s name on the report shown to me by Amarachi. She’s a friend that has been with me for a long time and our relationship is mutual and intimate.

“My decision is that I won’t want her name to go public. It is now a problem I would deal with at a private level. However, I have been betrayed.”

Speaking on the bank’s effort, Iynda said she was particularly thankful to Amarachi for her personal effort in fishing out the perpetrators’ identities.

Editor’s Note: FIJ originally reported that Iynda’s account was not compromised. The story has been updated to include the result of the bank’s internal investigation.

Subscribe

Be the first to receive special investigative reports and features in your inbox.