Adeola Okeke (not real name), an Ondo State-based lady, has narrated how an agent from Cashlawn, an online money lending company, sent her a series of unpleasant text messages over her inability to repay a N1,950 loan on time.

Okeke told FIJ that she had borrowed N1,950 from the company on November 3 with the hope of paying back N3,450 within seven days.

“Unfortunately, I had a motorbike accident on Tuesday, November 8, and the events that followed did not even allow me to remember the repayment I was supposed to make,” Okeke said.

READ ALSO: CamelLoan Forces Money on School Administrator, Blackmails Him Into Interest Repayment

“Because of the incessant calls I was receiving from family members and friends while receiving treatment, my husband decided to take the phone away from me.

“He said the phone calls would prevent me from getting adequate rest and switched it off. When I eventually returned home after five days at the hospital, I heard that Cashlawn had already sent defamatory messages to all my phone contacts.”

The Akure resident said the company’s decision to send the messages without hearing her side of the story made her resolve never to repay the loan.

“After sending the defamatory messages to my contacts, they again sent text messages to me on Wednesday, cursing me,” she said.

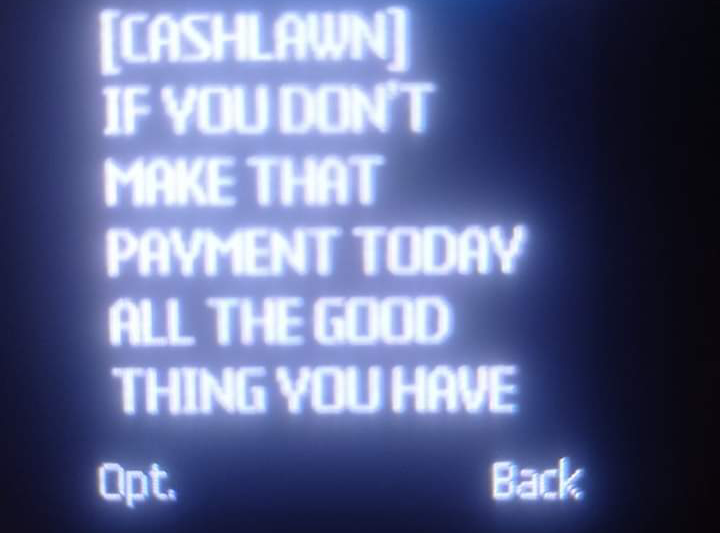

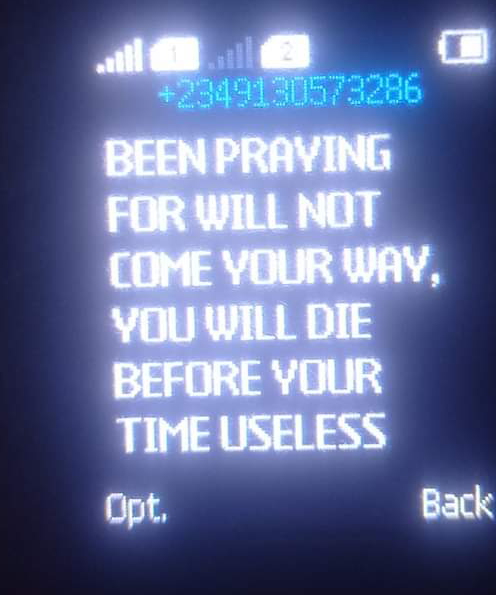

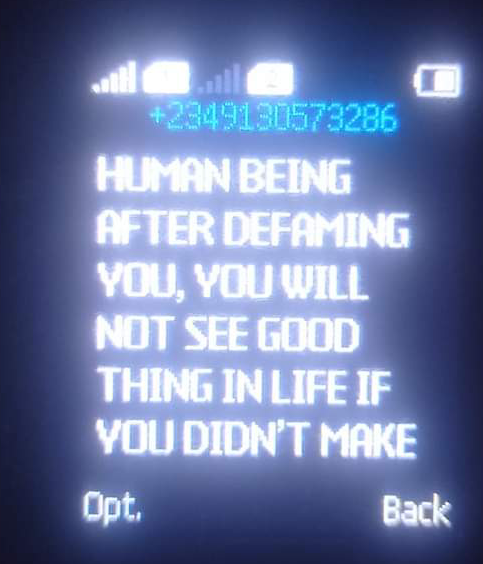

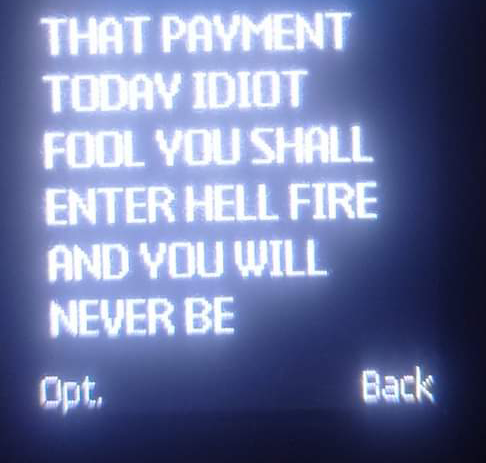

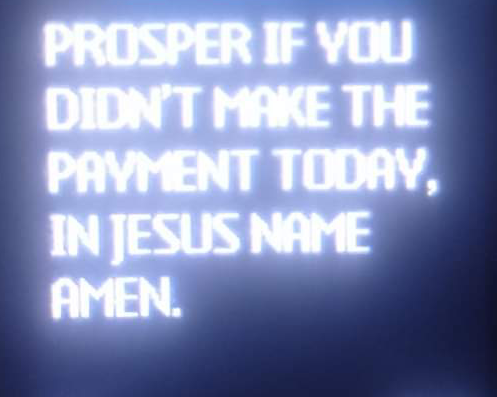

The loan company’s text messages read:

“If you don’t make that payment today, all the good things you have been praying for will not come your way. You will die before your time, useless human being.

“After defaming you, you will not see good thing in life if you didn’t make that payment today, idiot, fool [sic].

“You shall enter hell fire and you will never be prosper if you didn’t make the payment today, in Jesus name, Amen [sic].”

Okeke told FIJ that the company would no longer receive a dime from her because of its actions.

READ ALSO: Bibi’s Clover Delivers Defective Gown to Customer, Tells Her to Repair It

In August, the Federal Competition and Consumer Protection Commission (FCCPC) instructed fintech solution providers and telecommunication companies who were not duly registered businesses in Nigeria or had violated the privacy rights of borrowers to shut down.

Despite fines, sanctions and eventual shutdown of some of these firms, many of them have devised new means of harassing their debtors. Some of them have also changed their names and logos.

FIJ sent an email to Cashlawn for comments on the matter on Thursday, but it had not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.