The increasing use of social media has made it necessary for financial institutions to have dedicated accounts on popular social platforms for resolving multidimensional customer complaints in Nigeria, thereby saving time and reducing physical contacts with customers.

On the flipside, fraudulent individuals now create fake social media handles in the name of various banks and rip vulnerable bank customers off their money.

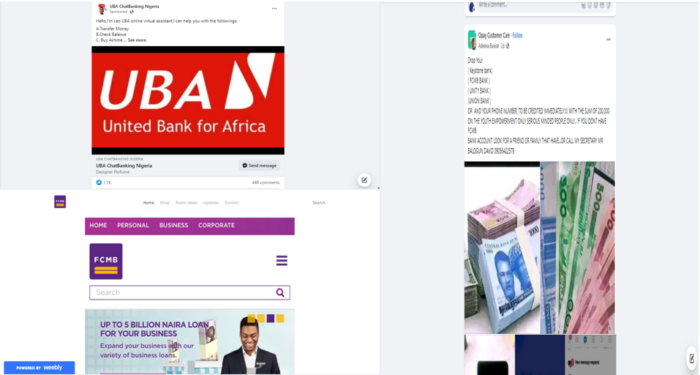

FIJ ran some checks on Facebook and detected a lot of counterfeit pages. It is important for bank customers to be wary of these pages to prevent fraudsters from accessing or compromising their data safety.

READ ALSO: ALERT: Fraudsters Impersonating Banks on Twitter — Over 100 Fake UBA Handles Found

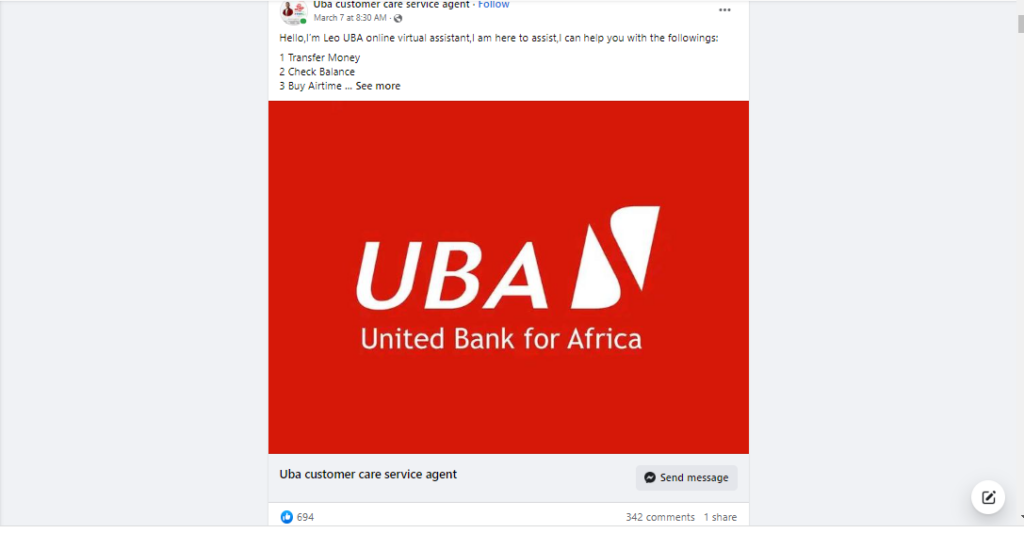

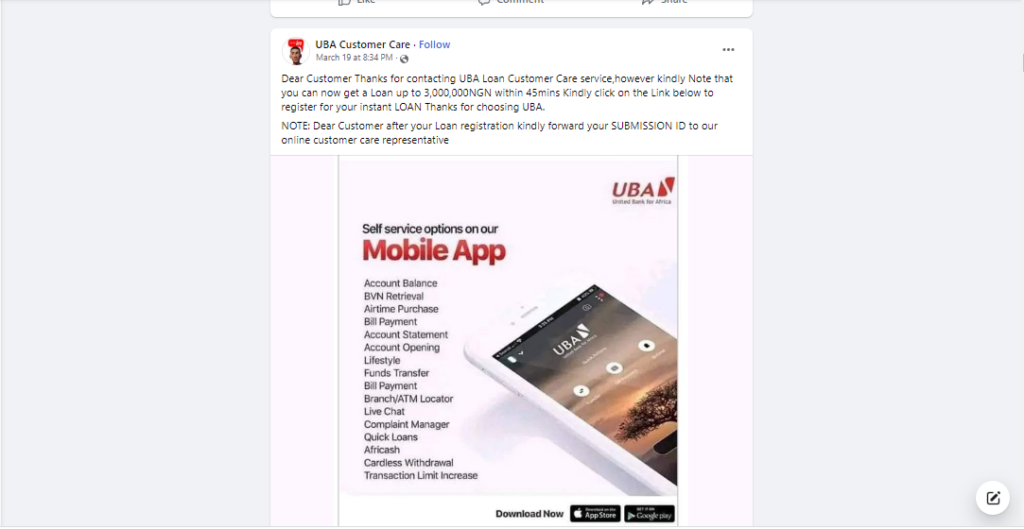

UNITED BANK FOR AFRICA (UBA) FAKE PAGES

A mere search of ‘UBA customer care‘ on Facebook returned a result showing not less than 29 illegitimate accounts.

These pages are fake, but it appears many customers of the bank are unaware. This is so because hundreds of the bank’s customers posted their complaints under these accounts, unconscious of the fact that the handles belong to faceless, fraudulent entities, and not the bank.

Most of the complaints were about unsuccessful transactions, questionable disappearances of money and loan requests. Some customers simply expressed their satisfaction with their banks or willingness to download banking apps.

In a chat with one of the pages on Facebook Messenger, the handler insisted that this reporter provide the first six and the last four digits of his bank card number to verify ownership of the card. When he provided 419419/0419, the handler said it was a wrong number and stopped responding.

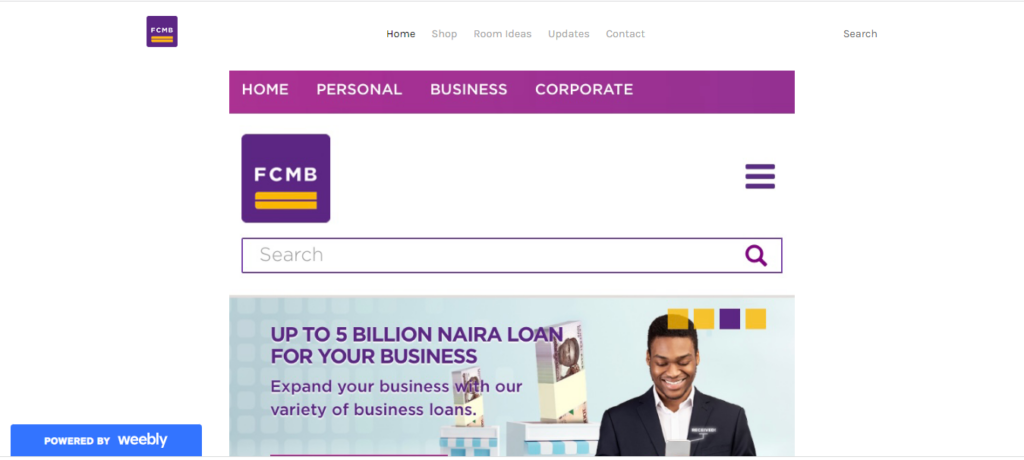

FIRST CITY MONUMENT BANK (FCMB) FAKE PAGES

There are also a number of fraudulent profiles targeting FCMB customers on Facebook. The faces behind these profiles do not represent the bank, but they have positioned themselves in a way that makes it easy for undiscerning customers to fall victim to their tricks.

READ ALSO: ALERT: Ogumbo Farms Resources, a Facebook Page, Scamming Customers

FIJ found five illegitimate pages claiming to be FCMB handles. One of the pages provided a link for FCMB customers to request loans. The fake offer on display could easily make a customer rush to apply and in the process expose their sensitive information to scammers.

FIJ clicked on the link to further explore the content contained in the information-stealing webpage.

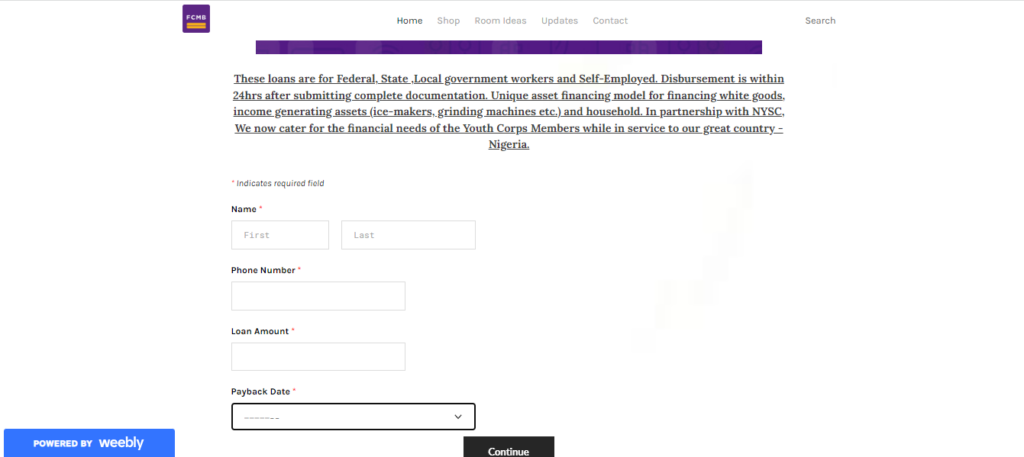

The tricksters said loans would be disbursed in 24 hours after application. They further said those eligible were National Youth Service Corps (NYSC) members and working class Nigerians.

The page reads:

These loans are for Federal, State ,Local government workers and Self-Employed. Disbursement is within 24hrs after submitting complete documentation. Unique asset financing model for financing white goods, income generating assets (ice-makers, grinding machines etc.) and household. In partnership with NYSC, We now cater for the financial needs of the Youth Corps Members while in service to our great country – Nigeria.

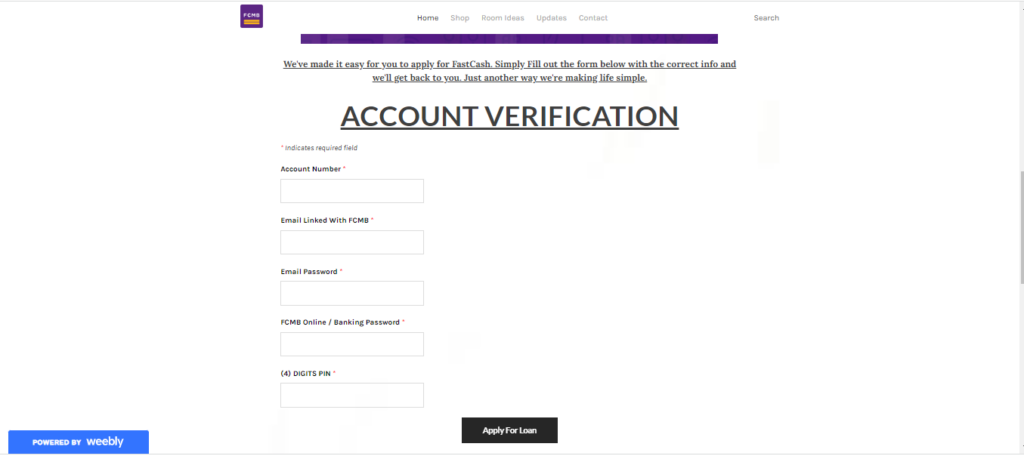

The next page was where potential victims would divulge their information and empower the conmen to illegally remove money from their accounts. The page required people to provide “account number, email linked with FCMB, email password, FCMB Online/Banking Password, (4) digits pin”.

OPay

A number of fake accounts purporting to be OPay customer service pages also exist on Facebook. FIJ found not less than 20 accounts pretending to represent the financial institution.

One of the pages encouraged people to call one Balogun David via 09056422579 to access an instant loan without necessarily being regular bank customers.

COMMON THINGS ABOUT THESE PAGES

Some of these fake pages run Facebook ads to increase their visibility and lure many people into their net.

The blue check, which stands true accounts belonging to financial institutions out, can help bank customers easily point out a fake account.

FIJ, however, observed that some fake pages have manually designed blue ticks on their profile pictures. It is fake. Original check marks stand apart from profile images.

READ ALSO: Lady Complained to Fake Zenith Bank Twitter Handle. She Lost N1m

Fraudsters operating these accounts also tend to communicate with professional terms. One thing they always do, which no bank would do, is ask for sensitive information, including personal identification numbers (PINs) and logins. Once they ask you to reveal your login, that is a red flag. You may take your time to report such pages to Facebook.

FIJ understands that banks have always advised their customers against divulging sensitive information online. The advisories discourage bank users from disclosing such information even to bank workers.

Bank customers can go to their banks’ websites to get correct complaint channels. You also have to be careful in revealing your crucial financial information to a third party.

Subscribe

Be the first to receive special investigative reports and features in your inbox.