Wasiu Adekola, an Oyo State-based banker, has narrated how Standard Alliance, a Nigerian Insurance Company, refused to pay him his policy funds worth N140,000 since its termination in 2020.

Adekola told FIJ he subscribed to an insurance plan with the company in January 2017 and it was to last until January 2022.

“I decided I was going to be putting N5,000 monthly into the plan. I also placed a standing order on my bank account such that the money would be deducted from source on the 20th day of every month,” Adekola said.

READ ALSO: Standard Alliance Insurance Company Fails to Pay Investor for 3 Years

“This went on for three years until a fellow subscriber told me that the company had refused to pay him his money after his plan matured.

“I got scared and called the officer attached to my plan that I wanted to terminate my policy. This was in 2020 after three years of subscription.”

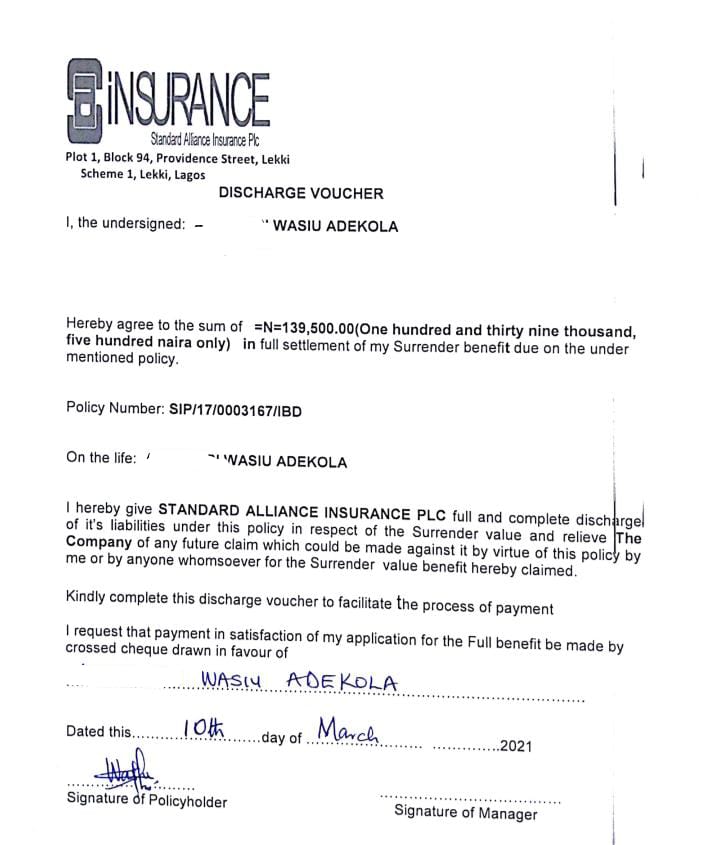

Adekola said the marketer processed his request and Standard Alliance would also later send him a discharge voucher.

“Standard Alliance Insurance sent me the Discharge Voucher saying that I won’t be paid the full insurance entitlement because they would be deducting penalty fees which was about 30 to 40 per cent of my savings.

READ ALSO: IGI Holds On to Deceased’s N1.3m Entitlement 11 Years After Her Demise

“The termination attracted the charges because I didn’t allow my policy plan to mature. I told them I did not mind the charges, I just wanted my money. The amount stated in the Discharge Voucher was N139,500.

“My premium would have been N180, 000 minus the penalty charges.

“However, after I had applied for my policy to be terminated, Standard Alliance Insurance criminally kept on deducting my money based on the initial standing order that the policy should be funded every 20th of the month.

“I was debited twice after I was sent my Discharge Voucher which should bring my entire premium to N149,500.

“Since I terminated the policy in 2020 I have made several calls to Standard Alliance. I have also sent emails and even visited one of their offices but they haven’t been forthcoming with paying my entitlement,” he said.

On May 21, FIJ had reported how the insurance company failed to pay an investor her insurance benefit of N1.7 million after maturity.

FIJ sent an email to Standard Alliance Insurance via its platform’s messaging system but it has not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.