Access Holdings PLC, the parent company of Access Bank Group, has declared N11.3 trillion in contingent liabilities in its latest annual financial report.

This comes seven months after FIJ reported how the company and several others were hiding or underreporting the value of legal claims against them in court.

In August 2023, FIJ published an investigation on how several entities listed on the Nigerian Exchange Group (NGX) had been quoting lower totals in their reports since 2014 despite being sued to the tune of N1.2 trillion in one case.

This they did to hide potential losses from their investors and stakeholders in violation of IAS 37 of the International Financial Reporting Standards (IFRS).

Between 2014 and 2022, Access Holdings did not state the specifics of cases against it or the monetary demands plaintiffs were making. They only stated financial provisions for potential losses.

On November 24, 2023, the Financial Reporting Council of Nigeria wrote to FIJ, saying it would introduce a rule to compel entities to adequately report contingent liabilities.

Its letter partly read, “Considering the potential consequences of insufficient disclosures in the financial statements of entities resulting from paragraph 92, Council has resolved to issue a Rule that will address this and other related matter(s). Over time, you shall see the effect of this in financial statements in the years to come.”

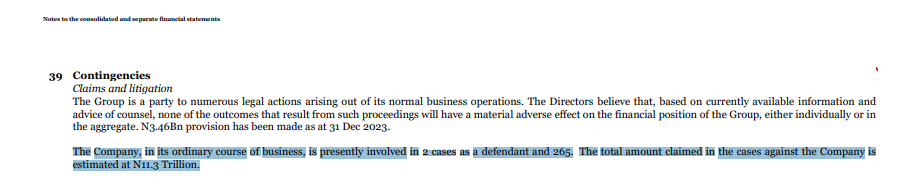

On March 27, 2024, Access Holdings published its 2023 audited financial report on NGX, and for the first time since its listing, the company stated a total figure for claims and litigation. This figure, according to them, was N11.3 trillion.

They wrote, “The Company, in its ordinary course of business, is presently involved in 2 cases as a defendant and 265[sic]. The total amount claimed in the cases against the Company is estimated at N11.3 Trillion.”

Other companies, like Guinness Nigeria PLC and United Bank for Africa (UBA) PLC, are yet to publish their annual reports. Guinness closes its fiscal year in June, while UBA does so in December. FIJ found that for its previous reports, UBA usually published in the first week of March, but as of press time, UBA was yet to publish its 2023 report, making it at least three weeks late by its standards.

Subscribe

Be the first to receive special investigative reports and features in your inbox.