“In other western jurisdictions, you see the [claims and litigation] disclosures running into pages, but here in Nigeria, they are always afraid…,” a staffer at the Financial Reporting Council of Nigeria told FIJ when we asked if the council was aware companies were underreporting litigation claims against them. DANIEL OJUKWU uncovered how some Nigerian companies violate IFRS’ IAS 37.

What does an African film festival, corporate organisations, financial regulatory agencies and audit regulations have in common? Nothing. Well, nothing on face value at least, but when a court case brings them all together, the similarities begin to unravel.

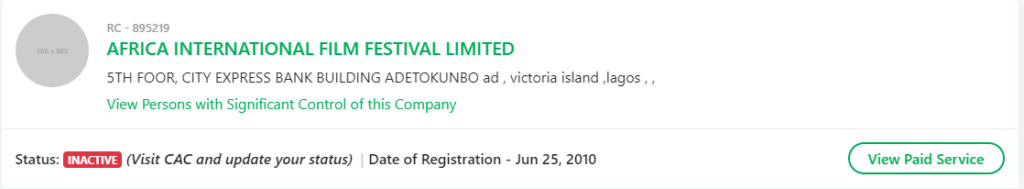

This story dates back to 2010, when Chioma Ude, popular businesswoman, launched the Africa International Film Festival (AFRIFF) in Port Harcourt, Rivers State.

Her event was held from December 1 to 5, 2010, and hosted some very popular figures in the Nigerian and African film industries.

It was also backed by the Rivers State Government, Total Nigeria PLC, Air France Nigeria, Multichoice and MRS Oil Nigeria PLC, amongst others.

However, while it appears as though Ude embarked on a harmless venture, her single move would lead to a long drawn-out legal battle over intellectual property infringement and the world of corporate financial under-reporting.

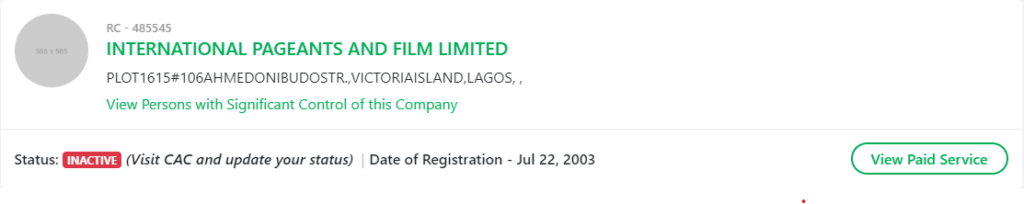

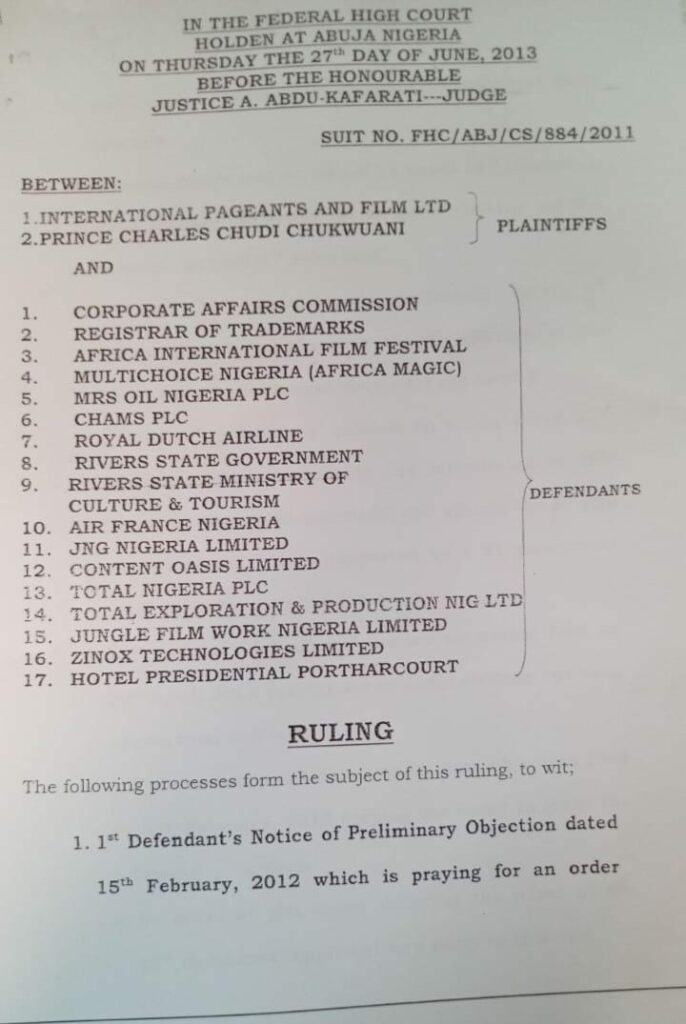

In 2011, International Pageants And Film LTD sued CAC and the sponsors of the event. Their claim? CAC allowed Ude to register her company name when there already had been an African Film Festival (AFF) in existence since 1990.

Founded by Mahen Bonetti, AFF hosted the New York African Film Festival (NYAFF) in 1993, and with the registration of the International Pageants and Film in 2003, the AFF was in Nigeria.

This was the reason International Pageants and Film took the CAC and AFRIFF sponsors to court.

While the court case was ongoing, one would imagine that all parties would lie low and await a court judgement, but lying low wasn’t Ude’s style. The AFRIFF founder hosted other AFRIFF events in 2011, 2013 and 2014. Every year there were new sponsors, investments, a larger scale and media attention.

This story is not about Chioma Ude though, but it is safe to say she does play a crucial role in how events unfold. With every new AFRIFF event came new investors, and with new investors came new defendants to the suit filed by International Pageants and Film.

Following those AFRIFF events, the AFF hosts and Charles Chukwuani, one of its directors, filed another lawsuit in the Federal High Court, Abuja. In the cases marked FHC/ABJ/CS/150/2014 and FHC/ABJ/CS/613/2015, the plaintiffs sued each company jointly and severally.

What they demanded was ₦1.2 trillion, and by suing each party jointly and severally, it meant the court could award the judgement sum on all parties or on one or more parties. In simpler terms, one defendant can be held responsible for paying the entire claim if the judge so rules.

CLAIMS AND LITIGATION: THE MURKY WATERS OF CORPORATE FINANCIAL REPORTING

When AFRIFF bagged its ₦1.2 trillion lawsuit, it meant Chioma Ude’s company and several other companies joined as defendants, now had the legal obligation to inform their investors, stakeholders and shareholders about the case, and about potential liabilities.

If they were only sued jointly, whatever claims awarded by a judge would be binding on all parties, but being severally sued, the claim became potentially binding on each individual defendant. The problem was, since the case’s 2014 filing, the companies had failed to report the claims against them in their annual financial report.

FIJ asked lawyers for their legal position on the matter.

Ridwan Oke, a human rights lawyer, told FIJ that when parties are severally sued, the judge can rule against one or more of the defendants, or against all. And in the event the judge does not stipulate how the claimant is to be paid if they win, the claimant can go after any of the parties for the judgement sum.

Festus Ogun, another human rights lawyer, backed this assertion. He said it was possible for a judge to find some parties to a suit guilty and some innocent.

When FIJ spoke with Monday Ubani, a former vice president of the Nigeria Bar Association (NBA), he said litigants go to court to make claims against companies, but the Nigerian courts do not necessarily award the claims and can award different figures in the end.

He, however, said in other countries, judges may award the sums the way they appear because of insurance. “The insurance companies pay for it, and not the sued companies, but companies in Nigeria do not do proper insurance to cover litigation,” he said.

Ubani added that if the companies failed to mention the cases and claims against them, “They are hiding that particular information. It is a breach because if there is an existing court case, companies write to lawyers like us to give updates on those cases and possible outcomes, and we tell them the claims against them and the possibility of liabilities.

“By omitting that piece of information, I am sure they have not complied with International Financial Reporting Standards (IFRS) as expected of them.”

FIJ asked if it was possible for companies to assume and estimate possible outcomes of lawsuits in their annual report, and Ubani replied saying, “While the claimants may have made their claims in court, the companies can state it and say that based on legal advice, they assume a certain sum would be awarded as liability to them in the event they and other parties sued lose.”

WHAT IS THE IFRS?

International Financial Reporting Standards (IFRS) are a set of accounting standards introduced to govern how particular types of transactions and events should be reported in financial statements. They were developed by the International Accounting Standards Board (IASB).

This IASB has a set of accounting standards it set up to guide certain aspects of financial reporting.

IAS 37 is a standard for accounting for and disclosure of provisions, contingent liabilities and contingent assets.

It describes contingent liabilities as “possible obligations whose existence will be confirmed by uncertain future events that are not wholly within the control of the entity”.

“An example is litigation against the entity when it is uncertain whether the entity has committed an act of wrongdoing and when it is not probable that settlement will be needed,” it states.

“A contingent liability is not recognised in the statement of financial position. However, unless the possibility of an outflow of economic resources is remote (distant), a contingent liability is disclosed in the notes.”

Going by this provision, all defendants in the suit had contingent liabilities of at least ₦1.2 trillion each.

It is important to highlight that in business, companies either have assets or liabilities. Assets add to the financial health of the company, while liabilities are losses. Contingent is a term that refers to something that is subject to probability or chance, and just as there are contingent liabilities, there are contingent assets.

ACCESS BANK, UBA, MRS, GUINNESS AND TOTAL ENERGIES ANNUAL REPORTS

On the Nigerian Exchange Limited (NGX) website, FIJ checked for some of the public limited companies listed as defendants. We found five of the companies, Access Bank, United Bank for Africa (UBA), Guiness Nigeria PLC, MRS Holdings Nigeria PLC and Total Energies Nigeria PLC.

We searched for the claims and litigation parts of their reports, and provisions made for contingent liabilities between 2014 and 2022.

We found that for 2014, none of the companies reported contingent liabilities. We also found that some companies made no provisions in some years. In 2015, Total Energies published ₦17 billion contingent liabilities, but after the court rejected a preliminary objection in 2016, they began filing ₦1.3 trillion contingent liabilities. This figure dropped to between ₦1.257 trillion and ₦1.27 trillion from 2017 to 2022.

By contrast, Access Bank’s 2022 report says they made ₦2.82 billion provisions for claims and litigations, but fails to list cases and total claims.

In 2021, Access Bank claimed that they had “866 cases as a defendant” and the total amount claimed in the 866 cases were about ₦1.08 trillion. This figure cannot be accurate when they are in court for ₦1.2 trillion in one case.

UBA’s highest recorded claims was a 2018 report in which it claimed there were 714 cases against it and the claims were ₦745.45 billion.

| Company | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Access Bank | Not documented | ₦1.22bn provisions (Zero cases made available) | ₦614mn provisions | No provisions | No provisions | Provisions of ₦312mn | Provisions of ₦1.9bn | ₦2.45bn provisions. 866 cases as a defendant and 258 as plaintiff as of Dec 31, 2020 | Provisions of ₦2.82 bn |

| UBA | Not documented | 577 cases and provision of ₦185 mn made available | 650 cases estimated at ₦482.92 bn | 705 cases and an estimation of ₦659.17 bn | 714 cases and an estimated liability of ₦745.45 bn | 644 cases and an estimated liability of ₦472.04 bn | 1,000 cases and estimated liability of ₦385.07 bn | 1,363 cases and an estimated liability of ₦698.95 bn | 1,422 cases and estimated liability of ₦666.124 bn |

| MRS | Not documented | Estimated liability of ₦17 bn | Estimated liability of ₦19 bn | Estimated liability of ₦7.09 billion and a provision of ₦46.14 mn | Estimated liability of ₦7.42bn, and a provision of ₦46.14 mn | Estimated liability of ₦1.29bn and a provision of ₦46.14 mn | Pending litigations of ₦20.6 billion and a provision of ₦46.14 mn | Pending litigations of ₦772.43million and a provision of ₦46.14 mn | Pending litigations of ₦1.2 trn and estimated liability of ₦711.93 mn |

| Guiness | Not documented | Not documented | Estimated liability of ₦1.514 mn | Estimated liability of ₦2.542 bn | Estimated liabilities of ₦1.744 bn | Estimated liabilities of ₦603 mn | Estimated liabilities of ₦953 mn | Estimated liabilities of ₦950 mn | Estimated liabilities of ₦958 bn |

| Total Energies | Not documented | About ₦17 Billion in contingent liabilities (no provisions) | About ₦1.3 trn in contingent liabilities (no provisions) | About ₦1.26 trn in contingent liabilities (no provisions) | About ₦1.27 trn in contingent liabilities (no provisions) | About ₦1.27 trn in contingent liabilities (no provisions) | About ₦1.268 trn in contingent liabilities (no provisions) | About ₦1.257 trn in contingent liabilities (no provisions) | About ₦1.257 trn in contingent liabilities (no provisions) |

FIJ asked Oluniyi Omotoso, an experienced auditor, for his opinion on the reporting. He said, “Auditors may not be liable for those disclosures. If I come to your house and ask how much you have, and you tell me ₦5, whereas you have ₦20, I would disclose the ₦5 you told me because auditors are not angels. What companies give auditors is what the auditors disclose.

“If a company has contingent liabilities that can materialise in the future, they need to create awareness for the shareholders and for prospective investors, but if the company does not make information available to the auditor, there’s nothing the auditor can do.

“There is an International Audit Standards that guides how companies should provide audit evidence. ISA 500 states it clearly. If shareholders rely on the information provided by that report and incur losses, they can sue the auditor for financial losses.”

FIJ called Chudi Charles, one of the plaintiffs in the suit against the companies, and he said he had joined the NGX, CAC, Central Bank of Nigeria (CBN) and other regulatory bodies for failing to do their fiduciary duties.

“Nigeria uses the International Financial Reporting Standards, and while regulatory bodies fail to sanction erring companies and auditors, they enable them to just report anything,” he said.

REGULATORS

The Corporate Affairs Commission (CAC) was established by the Companies and Allied Matters Act (CAMA), which was promulgated in 1990 to regulate the formation and management of companies in Nigeria.

On the other hand, the Financial Reporting Council of Nigeria (FRCN) was set up in 2011 to bring utmost confidence to investors, reputation to oversight and ensure quality in accounting, auditing, actuarial, valuation and corporate governance standards and non-financial reporting issues.

Meanwhile, there also exists the Securities and Exchange Commission (SEC). SEC is a government agency mandated to regulate and develop the Nigerian capital market.

The SEC’s mission statement reads, “To develop and regulate a capital market that is dynamic, fair, transparent and efficient, to contribute to the Nation’s economic development.”

Despite these clearly stated roles, FIJ checked for instances where these regulators fined any of the big four auditing firms, KPMG, Deloitte, Ernest & Young and PWC, but found none.

These firms all audited the sued companies between 2015 and 2022. PWC audited UBA from 2015 to 2019, audited Access Bank from 2015 to 2022, Guiness from 2016 to 2023 and Total Energies in 2022.

Ernest & Young replaced PWC as UBA’s auditors from 2020 to 2022. KPMG audited MRS Holdings from 2015 to 2019, and Total Energies from 2015 to 2021.

Deloitte was in charge of auditing MRS Holdings from 2020 to 2022.

While FIJ was unable to find sanctions against these companies in Nigeria, we found cases of sanctions here, here, here, and here.

WE KNOW WHY COMPANIES DO IT, BUT WE’RE TRYING TO STOP IT — FRCN

On Wednesday, August 9, FIJ wrote to the NGX to seek answers on why the government agency was publishing annual reports of companies with inaccurate claims and litigation.

FIJ also wrote to the SEC seeking the same answers. On the same day, FIJ visited the CAC Lagos office in Alausa, Ikeja, and the FRCN office in the same Alausa area of the state.

At the CAC office, we met a hurdle in form of security. An aged man likely in his late 50s told our reporter he could not allow him into the building as all their operations were online.

Our reporter told him his purpose was to have a physical conversation with a CAC representative to understand their regulatory framework and position on the annual reports, but the security personnel wouldn’t budge. Instead, he directed FIJ to call an automated customer care number.

One thing was certain, in the event we spoke with an automated customer care representative, we would not get a helpful response. The security personnel would not budge though, so we tried the number. By natural design or luck, the number was switched off, and we communicated this to the guard.

“Who did you say you are again, and who are you looking for?” He asked.

“I am a journalist, and I want to ask some questions on CAMA compliance.”

“Okay, bring your ID card, I would go inside and come back to you.”

With my ID card, he went into the building, spent some two minutes, and then emerged signaling to this reporter to come in.

When inside, FIJ met a CAC staffer who wanted to know our intention before divulging who he was or what his role was. After FIJ told him our intention, he said he was not the right person to speak with. He said we would have to write to the commission’s head office in Abuja.

He also asked that we pay ₦5,800 to access companies’ annual records. We told him we already had these records and it wsa with them we sought to ask questions. He then suggested we send an email to the CAC.

We sent an email,and got an automated response saying, “A request for support has been created and assigned (a code). A representative will follow-up as soon as possible. So, we waited.”

Meanwhile, we called the Lagos office of the FRCN, and a customer care representative asked that we send an email. Going by past experiences, we offered to come in person to see the executive secretary of the council. The customer care representative then transferred our call to one Theresa Odemena, secretary to the executive secretary.

Theresa asked that we write a letter, address it to the executive secretary and then bring it to the FRCN office in Alausa. We did.

When we dropped off our letter, we asked if the council had sanctioned companies or audit firms in the past, and if it kept records of this. On condition of anonymity, an FRCN staffer who said he was not the council’s spokesperson and was not authorised to speak to the press, told our reporter the council had issued sanctions in the past but chose not to publish it.

This staffer said, “Yes! In our meetings, we ask them to even make provisions for cases they’ve lost, regardless of whether they are appealing. In other western jurisdictions, you see the disclosures running into pages, but here in Nigeria, they are always afraid that when they make the disclosure, the claimant can go to court and say the company is already accepting guilt, thereby urging the judge to ask them to pay the claim.

“It is a top-burner agenda in FRCN and other agencies during inspection meetings, so we are on top of it, and trying to come up with a rule for how such instances should be treated in financial statements.”

When FIJ asked him if the council would probe previous infractions, he said, “The council will come up with a provision on that, for whether to treat prospective or retrospective cases.”

READ ALSO: Political Mortgage: The Flaws in Lagos State Government’s Housing Plans

On Thursday, April 10, NGX wrote FIJ back. Their email read, “Further to your email, kindly note that this complaint is best addressed to the Financial Reporting Council of Nigeria (FRCN) under whose purview lies the review of financial statements of companies and the accuracy of figures therein.”

As of press time, FRCN, SEC and CAC were yet to officially reply FIJ’s emails.

He said the issues contained in our letter were matters the FRCN was discussing with other regulatory bodies, preparing a new rule book to address it.

COMPANIES REACT

On August 3, FIJ called Ramon Olanrewaju Nasir, UBA Group Head, Media and External Relations. Nasir asked that FIJ send him an email. We sent him an email on the same day.

A day after, we called him to get updates on the matter, but he said the company would reply officially. As of press time, UBA was yet to respond.

FIJ called Abdul Imoyo, Access Bank’s Head of Media Relations, on August 3, and he asked that we send him an email, which we did afterwards.

A day after, he called us back to give a reply to our inquiry, and the conversation spanned 11 minutes of him defending the bank, but in a twist of events, Imoyo called hours later on August 4 to withdraw all statements he made to FIJ.

Imoyo said, “Everything we discussed earlier was a personal conversation. It was my personal position, and not the position of the bank, so wait for the bank’s official response. I cannot comment on a case in court.”

We reminded him that we were not asking him about details of the case but about the financial records his bank published, and if they under-reported or not. Imoyo said that our question was based on the case and we were trying to get him to comment on a court case.

At one point he asked, “You are saying we are under-reporting. Okay, tell me, of the over 1,000 cases we said we had in court, which one had the highest claim?” It was impossible to ascertain this as the report his bank published did not contain details of the cases, only that the total claims they said they had was less than a claim from one case they had against them.

FIJ sent emails to Guinness Nigeria PLC, MRS Oil Nigeria PLC and Total Energies Nigeria PLC, but as of press time, neither had responded to our email.

Produced with support from the Wole Soyinka Centre for Investigative Journalism (WSCIJ) under the Collaborative Media Engagement for Development Inclusivity and Accountability project (CMEDIA) funded by the MacArthur Foundation

Subscribe

Be the first to receive special investigative reports and features in your inbox.