On March 1, Patricia Udoh, a businesswoman based in Uyo, Akwa Ibom State, was in her living room when she received a text message from First Bank, a bank she had been making her savings with for close to ten years.

After reading the message, she concluded that it must have been erroneously sent to her, and never really took the contents seriously.

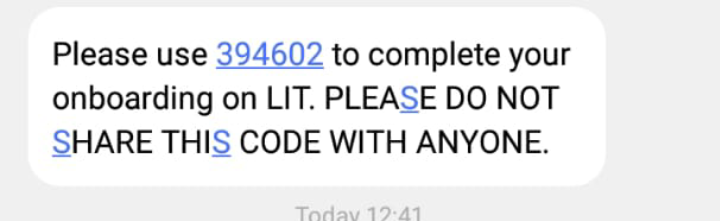

“The first message I received contained a six-digit code that was supposed to be used to complete my on-boarding on LIT, a First Bank mobile application,” Udoh said in a chat with FIJ.

READ ALSO: First Bank Deducts N240,000 From Paint Producer’s Account ‘For No Reason’

“But because my account had always been for the purpose of saving and not withdrawing, and because I had never at anytime requested any enrollment on the bank’s mobile app, I never thought it would eventually become a problem at the end of the day.”

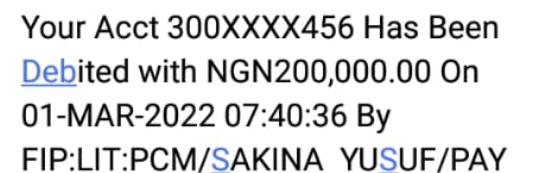

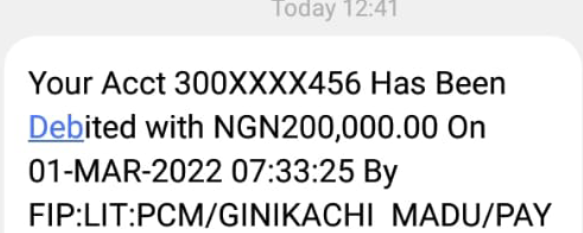

Moments after getting the first, she received another message. This time, it was for a debit alert of N200,000.

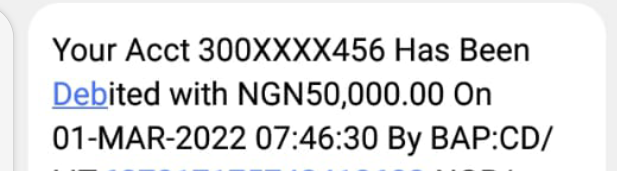

“As I was still wondering where the authorised debit of N200,000 could have come from, I received yet another debit alert of N200,000. By the time I could say I wanted to call my bank for assistance, a third debit alert of N50,000 had impacted my phone,” she said.

By the afternoon of the same day, a total sum of N450,000 had been fraudulently deducted from her account.

READ ALSO: After Abandoning Successful 2021 Candidates, Army Calls for Fresh Course 26 Applications

“This was a mobile application I had never for once requested in the past. I immediately went to the bank to lodge a complaint and after taking my request, the official on duty promised that it would be resolved, and that I should give them 14 days,” she said.

However, after the 14 days that were promised, no concrete feedback was got from the bank.

“I have visited the bank three additional times after the first visit, but, till we speak, nothing has been done by its officials to ensure that my money is reversed. I want my money back as urgently as possible. If things can be happening at a bank like First Bank, then it means our savings are no longer safe with them,” Udoh further said.

READ ALSO: Ethiopian Police Arrest Three Nigerians for Cocaine Smuggling

FIJ contacted First Bank via their customer care number, but it did not connect. As at press time, none of its officials had responded to an email sent to them.

Subscribe

Be the first to receive special investigative reports and features in your inbox.