An Ogun-based telecommunications engineer has shared how Chipper Cash, a digital bank, did nothing after N183,900 disappeared from his account on June 30.

The engineer, who wishes to remain unnamed, told FIJ that he noticed his account had been compromised when he could not log in to make transactions on June 30.

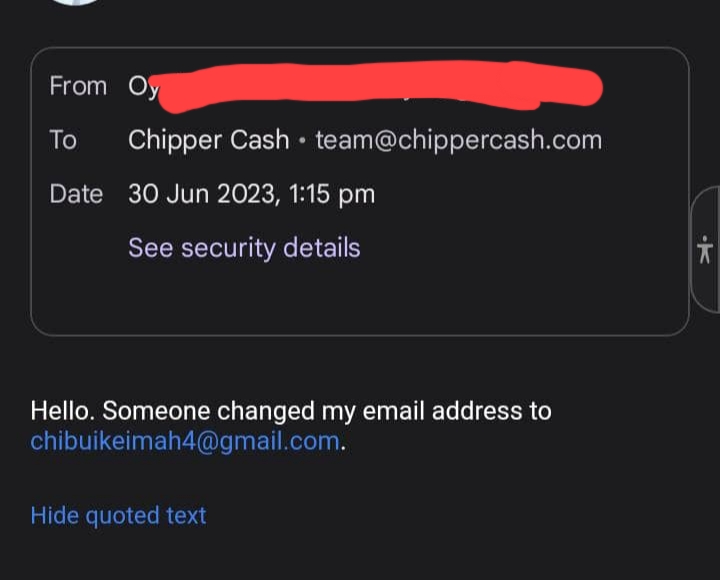

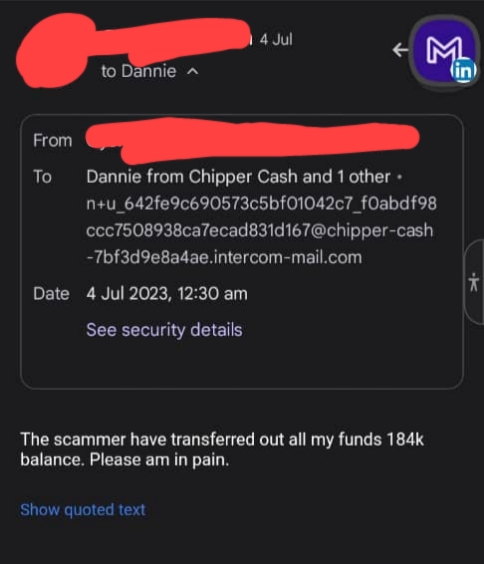

“I saw that someone had changed my email address to [email protected]. I emailed Chipper Cash that day to inform them about the unauthorised access to my account,” the engineer told FIJ on Wednesday.

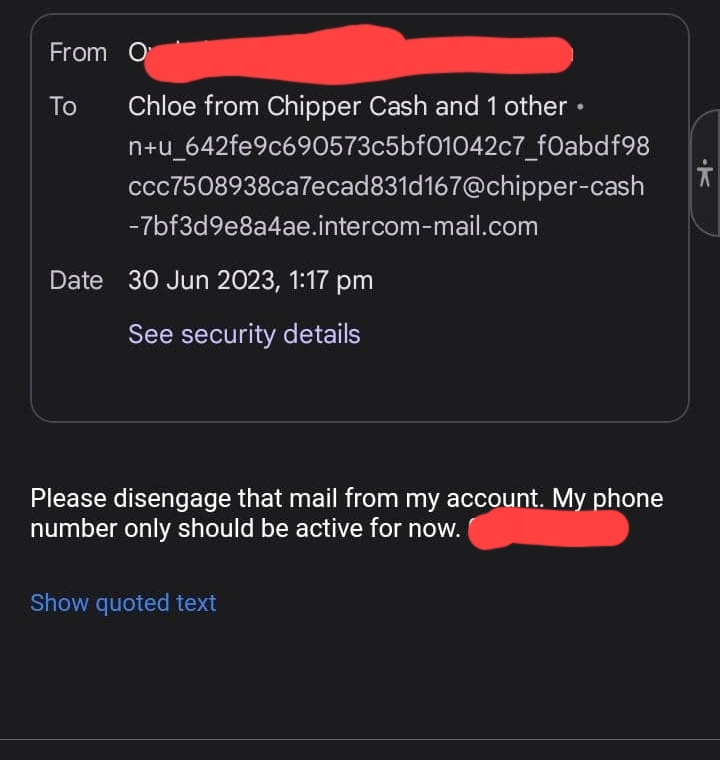

As seen in some of the emails he sent, the Ogun State resident asked the digital bank to deactivate his account to prevent the hacker from carrying out any nefarious activity with it.

A Facebook search linked the hacker’s email address to one Chibuike Imah.

READ ALSO: Hacker Steals N66,000 From Anambra Student’s Bank Account Through SportyBet

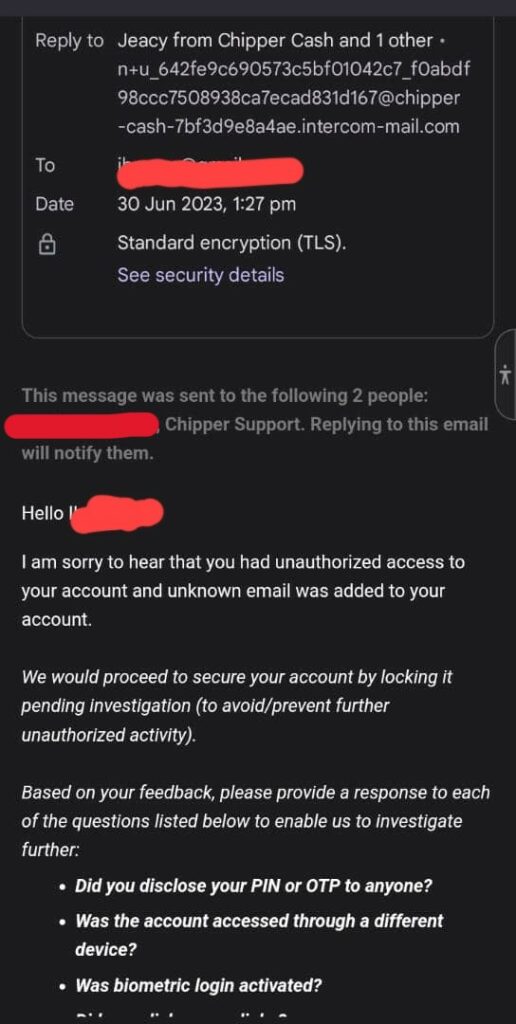

“I also asked that the unknown email be removed from my account, but it seemed nothing was done about restricting the hacker’s access to my Chipper account,” he told FIJ.

When the engineer eventually regained access to his account on July 4, the hacker had transferred N183,900 from his account since June 30 when he noticed the suspicious activity.

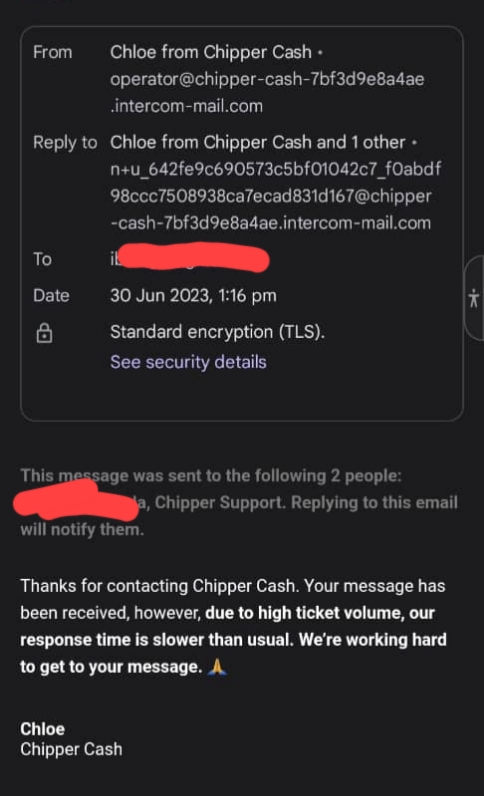

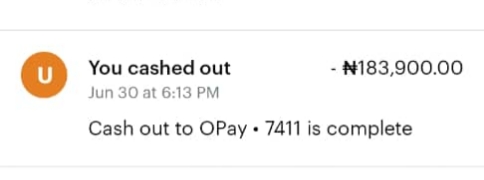

FIJ observed that this telecoms engineer reported this incident around 1:00 pm on June 30 and the company responded around the same time. Chipper Cash assured him that his account would be locked to prevent further unauthorised activities. But, despite notifying Chipper Cash ahead of time, the person who compromised his account transferred the money at 6.13 pm on the same day.

“I emailed Chipper Cash again on July 4 to tell them that my money had been stolen since June, and they said I would receive feedback within 14 working days. But it is almost two months since then with nothing to show for the wasted time,” the engineer said.

“Chipper has not been able to recover the funds since then. The company has not been supportive at all. How did they allow unauthorised access to my account in the first place?”

Meanwhile, the telecoms engineer decided to make his own findings while awaiting Chipper Cash’s response.

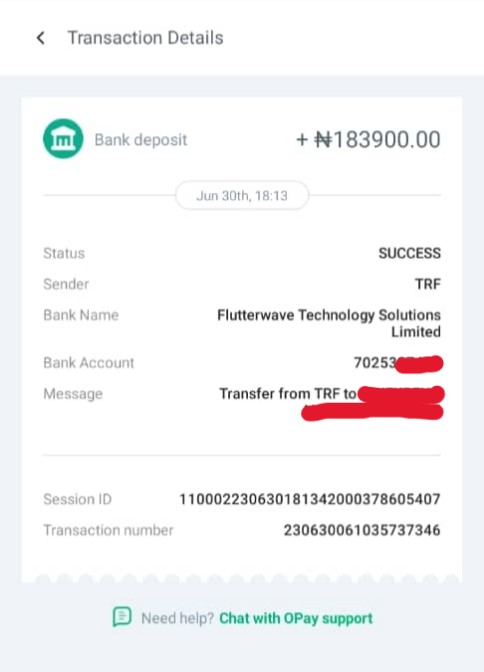

Having found that the hacker transferred the money to an OPay account and considering that OPay users’ phone numbers automatically served as their account numbers, he decided to reach out to the account owner.

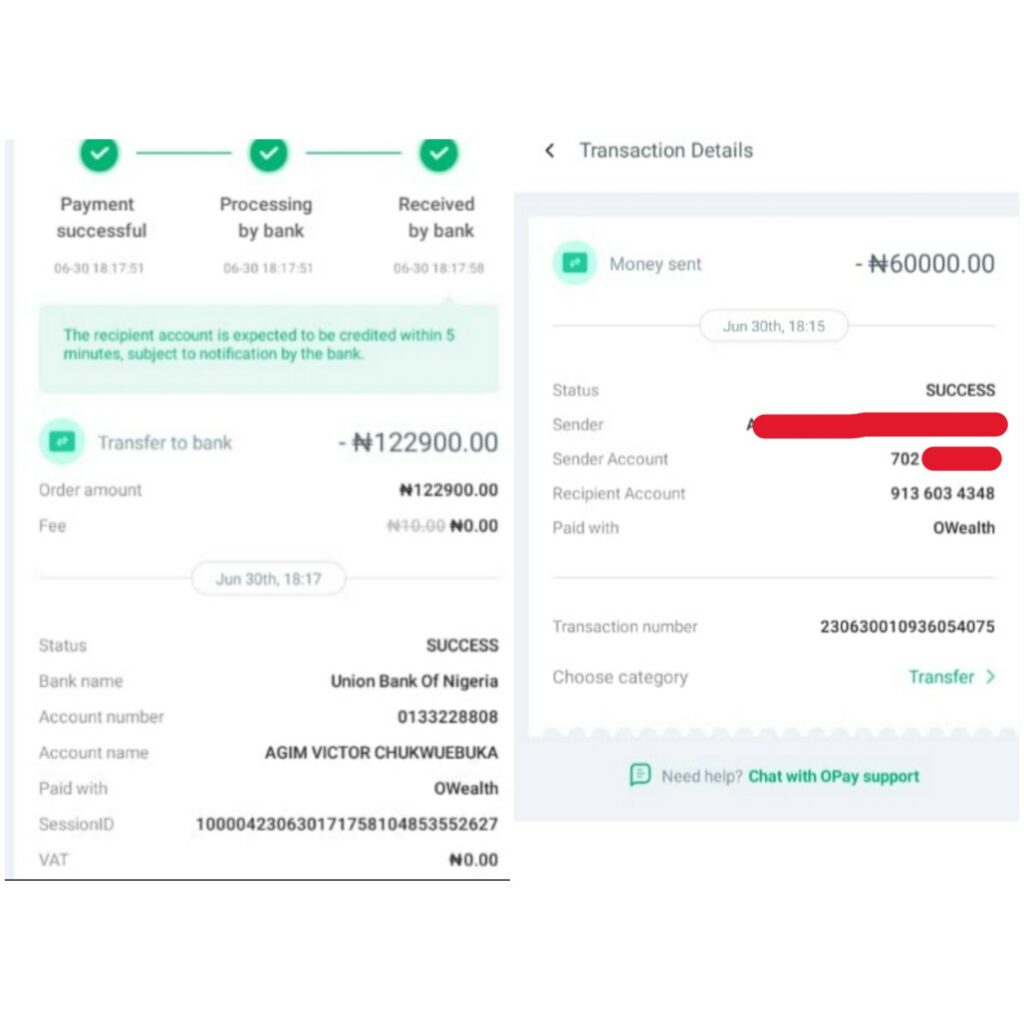

“When I called the guy, I found that he was a Point of Sale (PoS) merchant. He told me that he was having issues with his OPay account. He said his N40,000 was frozen,” the engineer explained.

“I also learnt from the PoS guy that the hacker had told him to deposit the money into two different account numbers. He sent me the receipts of these transactions and I made a follow-up report to Chipper Cash about my findings, but their support team has not been forthcoming since then.”

READ ALSO: Hacker Steals N124,000, Empties Account After GTBank Restricts Customer’s Access

The receipts showed that N122,900 was transferred to a United Bank for Africa (UBA) account belonging to one “Agim Victor Chukwuebuka” while N60,000 was sent to an OPay account that belonged to “Shaba Ahmed GIRAGI”.

When FIJ reached out to Chipper Cash on Wednesday, a customer care representative said the digital bank would be “unable to act on requests from anyone other than the actual owner of the account.”

He said the engineer should be informed to contact them directly via email so that they could assist.

In response to FIJ’s subsequent message, stating that the telecoms engineer had reached out to the institution several times, the customer representative wrote:

“We have already sent your inquiry to the relevant team for further review. We’ll keep you posted on any updates regarding the situation. We sincerely appreciate your understanding and cooperation.”

Subscribe

Be the first to receive special investigative reports and features in your inbox.