Some Globus Bank customers have accused the bank of ‘stealing’ thousands of naira from them after restricting their accounts without explanation.

Three of the customers told FIJ that the bank debited them each on October 27, 2023, a few days after they noticed that they had been restricted from carrying out transactions.

FIJ gathered that the Globus Bank customers are part of a WhatsApp group one of them described as an arbitrage group.

FIJ understands that they, alongside several others, bought forex from the bank at the rate of N980 per dollar between October 20 and 22, 2023. Then on October 23, the bank restricted their accounts.

READ ALSO: N246,500 Sent to Polaris Bank 2 Months Ago Is Still Missing

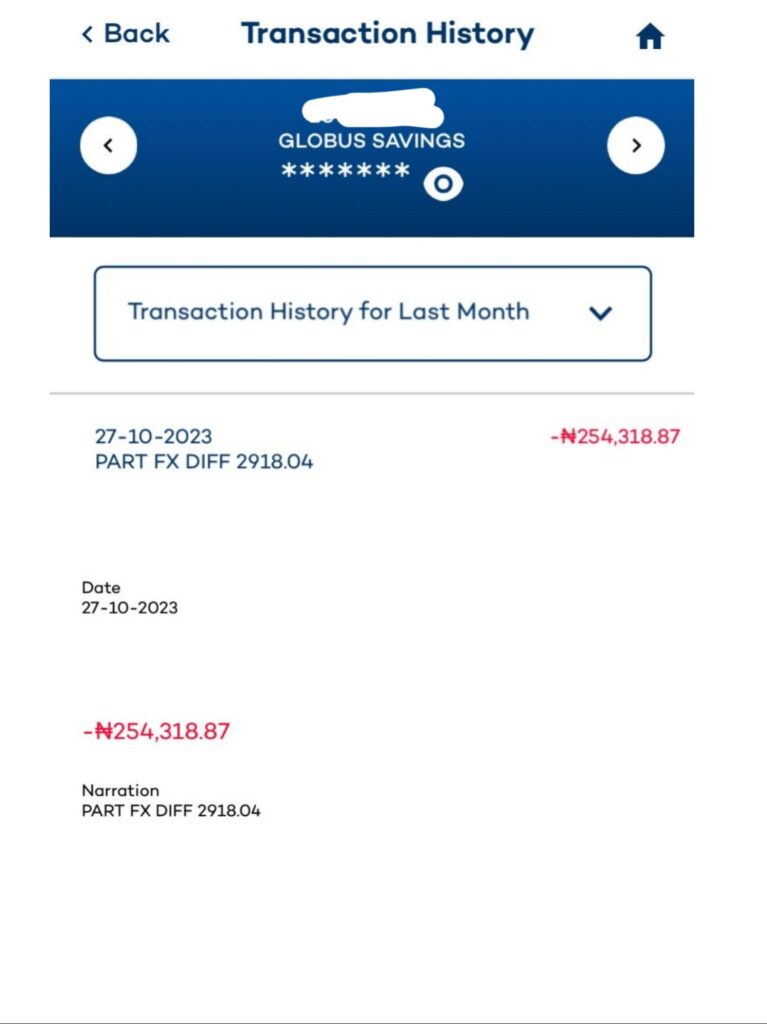

An Ondo-based digital asset investor, who does not want to be named, told FIJ that he bought a total of $2,918.04 forex using his Globus Bank Visa debit card at the rate of N980 per each dollar.

ACCOUNTS RESTRICTED AND LATER DEBITED

This means he paid N2.8 million for the forex he purchased. But the bank later deducted N254,318 from his account with the narration, “PART FX DIFF.”

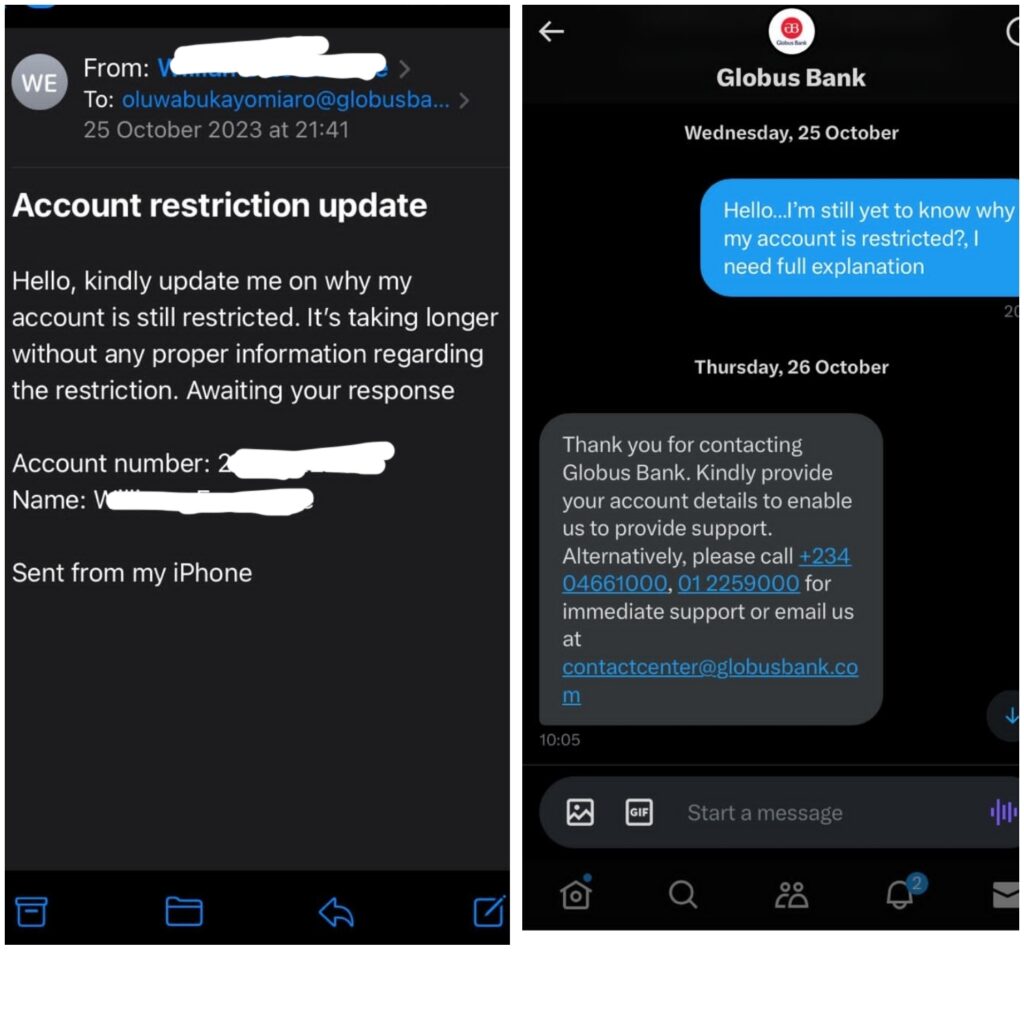

Prior to the deduction, the bank had restricted his account. When the Ondo resident complained about the restriction, the bank did not give a clear response.

“I was debited accordingly when I bought the FX between October 20 and 22. How then can a bank, after selling fx at 980/$ against the Investors & Exporters FX window (I&E FX window) rate after a week, say they made a mistake and debit my account of N254,318.87?” He asked.

“First they restricted the account during the week, and then debited it on Friday evening.”

While explaining how he found out about the restriction, the Ondo resident said, “I noticed that my account was restricted when I wanted to make a transfer on Monday, October 23. I called the customer service, and I was told they could not find any reason why my account was restricted. I sent messages too.”

Afterwards, he went to a branch of the bank located in Alagbaka, Akure, on October 25 and 27 respectively to know why his account was restricted.

Like the response he received when he called, the customer service agent could not give any reason for the restriction.

“She said she would have to email her superior to find out if there was any reason why my account was restricted. I waited for two hours, but they could not come up with any feedback. I had to leave the bank because I had other things to do.

“I then emailed them back for feedback, but they did not respond. I called the customer service, but there was still no reason.

“Fast forward to October 27, I noticed a debit on my account. They debited N254,318.87. The description for the debit was PART FX DIFF 2918.04. I was furious and wanted to know why they would debit that kind of money.”

When he contacted the bank to dispute the additional debit, a staff member explained that the bank had mistakenly sold him FX at N980 each, which was not the intended rate, and that they had to debit him for the difference.

“They said they made a mistake and they were now debiting me the excess.”

READ ALSO: Between Air Peace and Fidelity Bank, Journalist’s N153,400 Hangs

‘WE ARE MORE THAN 100 AFFECTED PEOPLE’

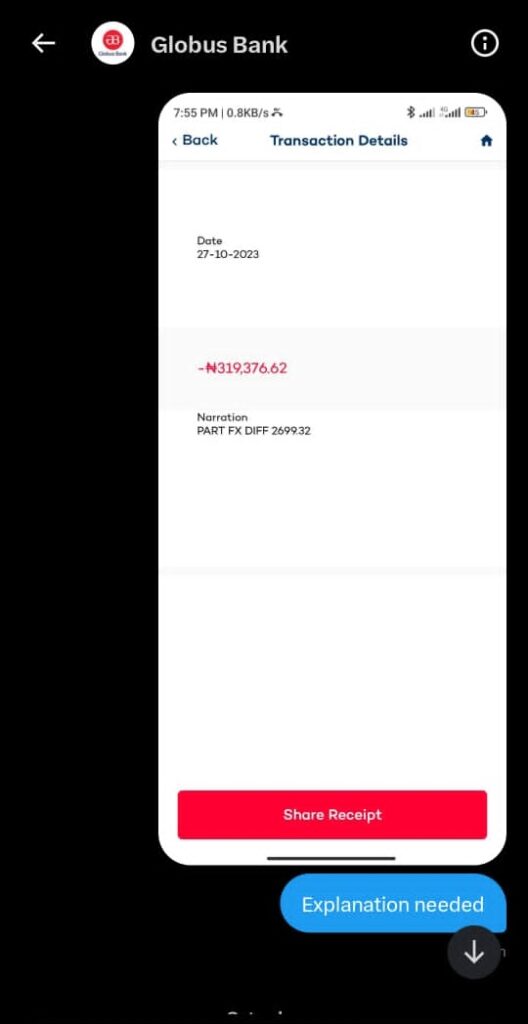

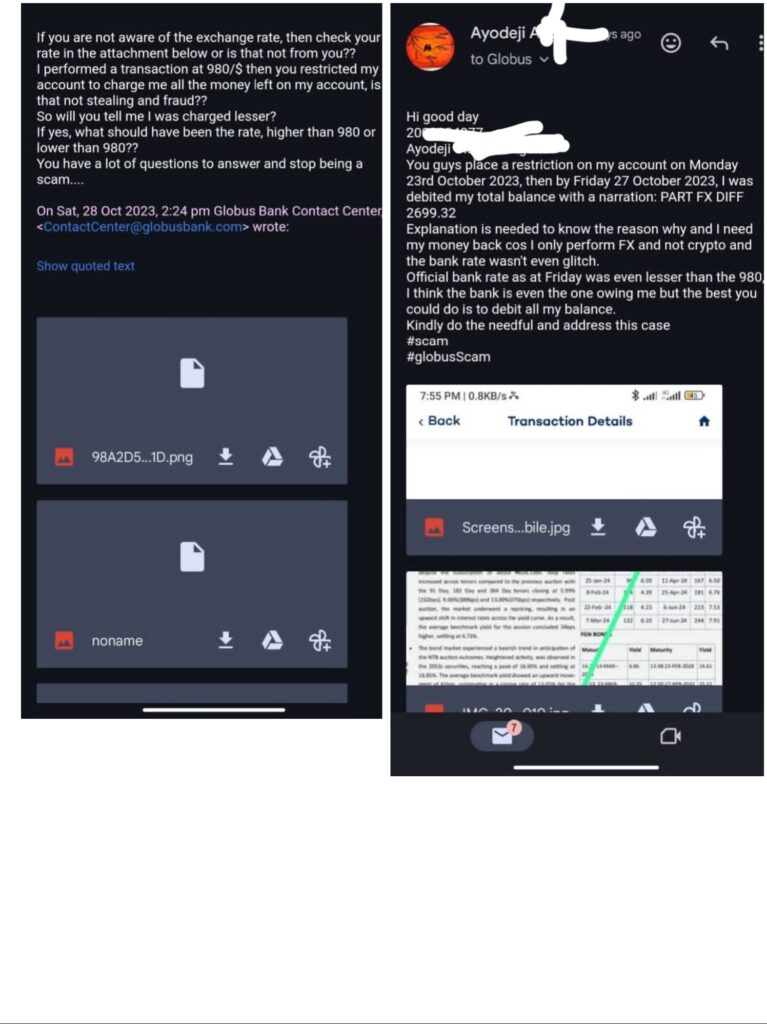

Another customer, who prefers to be addressed as Ayodeji, told FIJ that he also bought forex worth $2699.32 at the same rate of N980 per dollar.

Ayodeji’s bank account was later debited with an additional N319,376 on October 27, after he had made several complaints to the bank about his restricted account.

FIJ learned from Ayodeji that more than a hundred of other forex traders were affected by the restriction and additional debits.

“On Monday afternoon, I wanted to make some transfers and saw that I could not do so. I reached out to the bank and went there several times. Before the extra debit, they said they were investigating the restriction. And then on Friday, I was debited. The bank did not explain anything to us,” said Ayodeji.

“We did FX, not crypto, yet they restricted our accounts. They said the rate we were charged at N980 per dollar was low and that was why they were charging us. I said they should have informed us before going ahead to debit us for the so-called differences.

“When I asked them for the rate they charged us, they said they would ask their settlement team, but we have not received a response since then. When I messaged them again on Monday, they told me that I was still owing them. I insisted on knowing the rate they were charging us.”

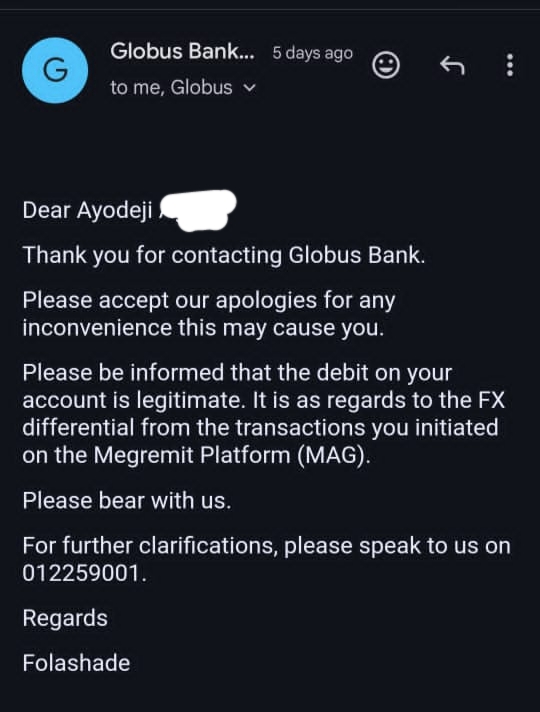

In one of its emails, Globus Bank told Ayodeji that the debit was legitimate and “it is as regards to the FX differential from the transactions you initiated on the Megremit Platform (MAG)”.

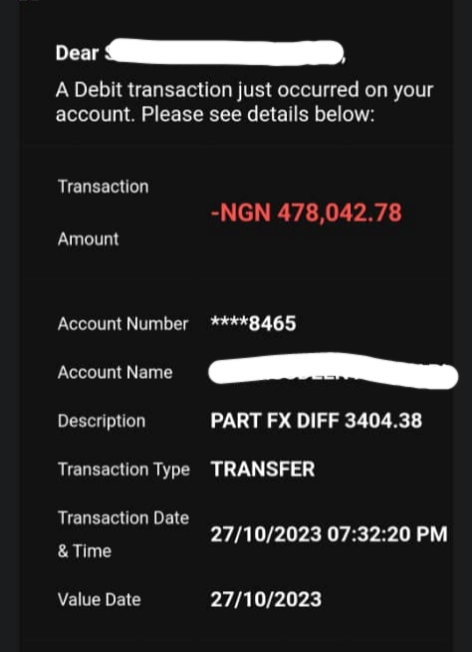

Shamsudeen Zakari, a Kano State resident whose N478,096 was debited as part of the FX difference on October 27, told FIJ that he bought forex worth $3404.38.

Zakari’s narration corroborated the Ondo resident and Ayodeji’s description of the unexplained restriction and debit.

“I went to the bank on October 24 to make a complaint about the restriction, and they said they would rectify it. I was asked to come back the following day, but I couldn’t go,” he said.

“But on Friday, I just received a debit alert of N478,042. I called, emailed and chatted with them via social media, but no good response from them.

“We are more than 300 people who were affected. They are just trying to play with our senses.”

“I wonder why they restricted my account and went on to debit me. I use my account for business, and they are debiting me without any explanation.”

DIFFERENT DOLLAR RATES FOR EACH CUSTOMER

Meanwhile, FIJ found that the rates at which these three Globus Bank customers were charged per dollar were slightly different.

The Ondo investor was initially debited N2.8 million for $2918 worth of FX, but with the extra debited N254,318, the bank deducted a total of N3.1 million at N1067 per dollar.

For Ayodeji, who was debited the sum of N2.96 million in total for the $2699 FX he bought, he was charged N1,098 per dollar.

The Kano resident, on the other hand, was debited a total sum of N3.8 million for the $3404 worth of FX he bought. This means he was debited N1,120 per dollar.

When FIJ contacted Globus Bank on Friday afternoon, a customer care representative identified as Glory asked our reporter to visit a branch of the bank.

“Visit the branch for further information, as I can’t relate any information to you,” said the representative.

Subscribe

Be the first to receive special investigative reports and features in your inbox.