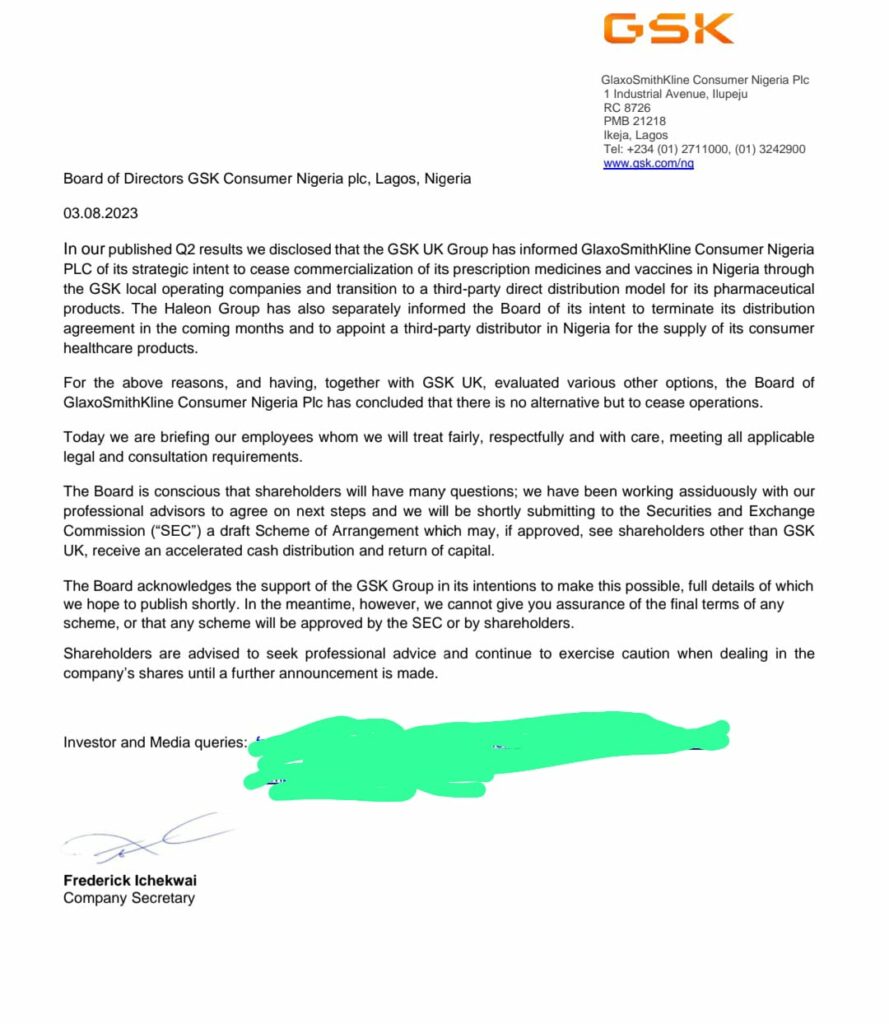

In August 2023, GSK UK PLC, formerly known as GlaxoSmithKline PLC, a British multinational pharmaceutical and biotechnology company, announced plans to discontinue its operations in Nigeria.

This was after the company, known for producing household and medicinal products like Panadol and Sensodyne, had spent 51 years in the Nigerian market.

While exiting, the company, known as GlaxoSmithKline Consumer Nigeria PLC in Nigeria, gave factors like scarcity of forex, increased competition from local firms, and a strategic review of their African drug and vaccine supply operations as reasons for the exit.

Some Nigerians have also attributed the exit of GSK and some other foreign companies to the economic policies of the Bola Tinubu administration.

READ ALSO: Ponzi or Business? Inside ‘Billionaire Policeman’ Aderemi Adeoye’s Alpha Trust Investment Club

Insiders within the organisation would, however, talk to FIJ on the incident, making it clear that GSK UK, the pharmaceutical giant’s mother company, exited the Nigerian market solely for profit.

INITIAL EXIT PLAN

The first insider, who spoke with FIJ on condition of anonymity, said he joined GSK at a time when its watchword was putting the patient first.

“Unfortunately, the value changed over time, and it was eventually abandoned for profit-making,” said the source.

“Presently, the public is being made to believe that the company left Nigeria due to a shortage of forex.

“That is not the case. GSK’s plan to exit Nigeria was put in motion about 11 years ago, way before the issue of a forex shortage came up.

“I must also let you know that the company was quite deceitfully methodical while executing the plan.”

The source told FIJ that GSK first attempted a “hostile takeover” of the majority of the company’s shares in 2013 but the move was rejected by its local shareholders.

READ ALSO: Angry Mother-in-Law Accused Islamic Cleric of Raping a Minor. He Proved His Innocence — But After 3 Years in Prison

“With this resistance, GSK could only retain 46 percent of shares in the Nigerian business, while local shareholders held on to 54 percent,” said the source.

“After the failed attempt, GSK approached the shareholders, proposing the global sale of its drink business in Nigeria.

“The shareholders were approached twice before they eventually agreed to selling the business at a record $79.2 million to Suntory Beverage & Food Nigeria Ltd. This happened in 2016.”

One of the conditions the shareholders gave GSK Nigeria before the drink portfolio was sold was that part of the proceeds would be spent on the local manufacturing of drugs and vaccines, especially antibiotics.

“After selling the drink portfolio that included products like Ribena and Lucozade, to Suntory and after GSK had also cleared all its debt, the company was still left with about $40 million. The sum could have been used in building an antibiotics factory in Nigeria,” said the source.

“Unfortunately, GSK reneged on the agreement it had with the shareholders and never built the factory. That is why it would be hard to argue that its exit from Nigeria was not pre-planned.

“Rather than build a factory, the company advised the shareholders to share the proceeds as dividends. In the end, they all agreed to a one-time N7-per-dividend payment.

“This then left GSK Nigeria with little foreign exchange in its accounts. The money could have been used to manage transactions when the forex shortage issue later came up.

“In reality, GSK seized the moment to reduce its footprint in Nigeria.”

2017 HERALDED THE EXIT OF GSK FROM SOME AFRICAN COUNTRIES

In 2017, there was a change in GSK UK’s leadership. Andrew Witty, the erstwhile CEO, stepped down and was replaced by Emma Walmsley, the current CEO.”

When Walmsley took charge, GSK came up with the narrative that its channels in African countries were no longer profitable.

“So, the distributor model was introduced under a scheme called Project Accelerate,” another former GSK staff member, who also asked not to be named, told FIJ.

“With the project, GSK no longer promoted its products on its own. The plan was now just to distribute and make profit by eliminating GSK local employees and company-sponsored local health programmes.

READ ALSO: SPOTLIGHT: Hezekiah Toyinbo, Okada Rider and Labourer Who Graduated With First-Class Honours

“This move ultimately delivered approximately 13 to 25 percent profit margins to GSK at the expense of the African patient.”

The strategy also led to the company exiting 15 countries in Sub-Saharan Africa.

HOW AND WHY THE NIGERIAN BUSINESS WAS ELIMINATED

In addition, the company subsequently exited Kenya and South Africa.

“After exiting these 17 countries, the only country left in Africa, and the one they had difficulties leaving, was Nigeria,” said a third source, who also asked not to be named.

READ ALSO: How Abeokuta Farmer Kazeem Dosumu Single-Handedly Built a Bridge for His Community

“Under Walmsley, GSK went into contract manufacturing with Fidson in 2019. The move made the shareholders believe GSK had a plan for Nigeria. That was, however, not the truth.”

The source added that the action was followed by GSK’s decision to stop shipping pharmaceutical products to Nigeria. This happened in 2022, while the company was working on its final plan to exit Nigeria in 2023.

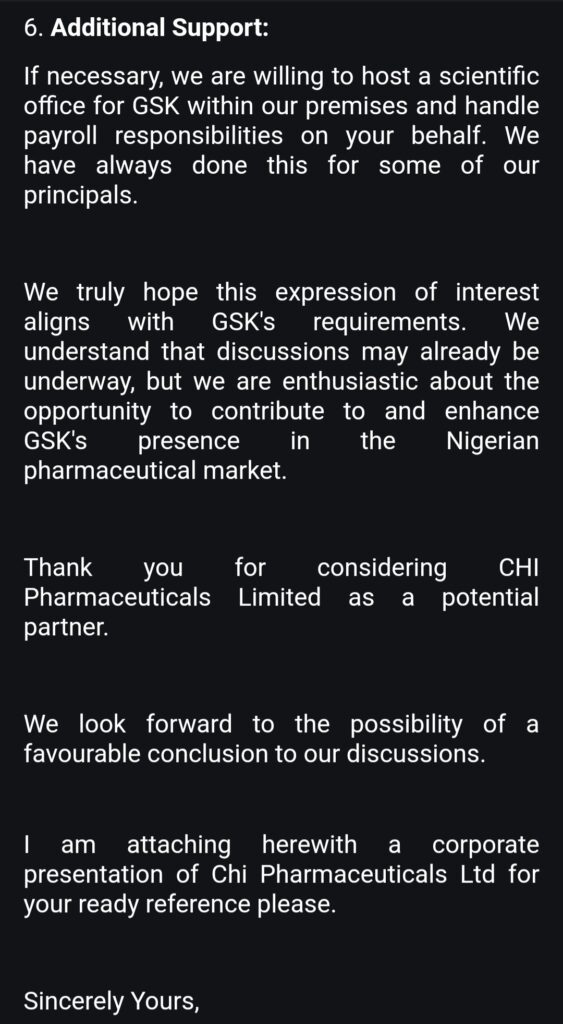

THE FINAL EXIT STRATEGY

“For its final exit, the first important step GSK UK took was have its senior executives travel down to Nigeria in January 2023 to have a meeting with Edmund Onuzo, the chairman of the board, alone,” said the source.

READ ALSO: After Forcing Nigerian Doctor to Treat Daughter Twice, Canadian Hospital ‘Bullies’ Him for Complaining

“If anything, the team was supposed to meet with the entire board on company transactional matters and not with the chairman alone.

“It was a clear divide and conquer move.”

According to the source, Onuzo was informed of GSK UK’s plans to stop the supply of products to Nigeria at the meeting. He was also asked to agree to the company’s planned exit.

“In response, the chairman advised the delegation to officially write the entire board, informing them of the exit plan,” said the source.

“When it was time for GSK to send the letter, however, the company cleverly stated that it was having problems in its operations because of a forex shortage and, as a result, would have to exit the country.

“Interestingly, the same GSK consistently supplied Ukraine drugs while at war with Russia. As we speak, drug supply to Ukraine hasn’t stopped.

“Clearly, the reason GSK stated in the letter was not valid.”

READ ALSO: SPECIAL REPORT: In Igbokofi Border Community, Pregnant Women and Infants Are Dying — And Ogun Gov’t Is to Blame

CHI PHARMACEUTICALS’ OFFER TO GSK

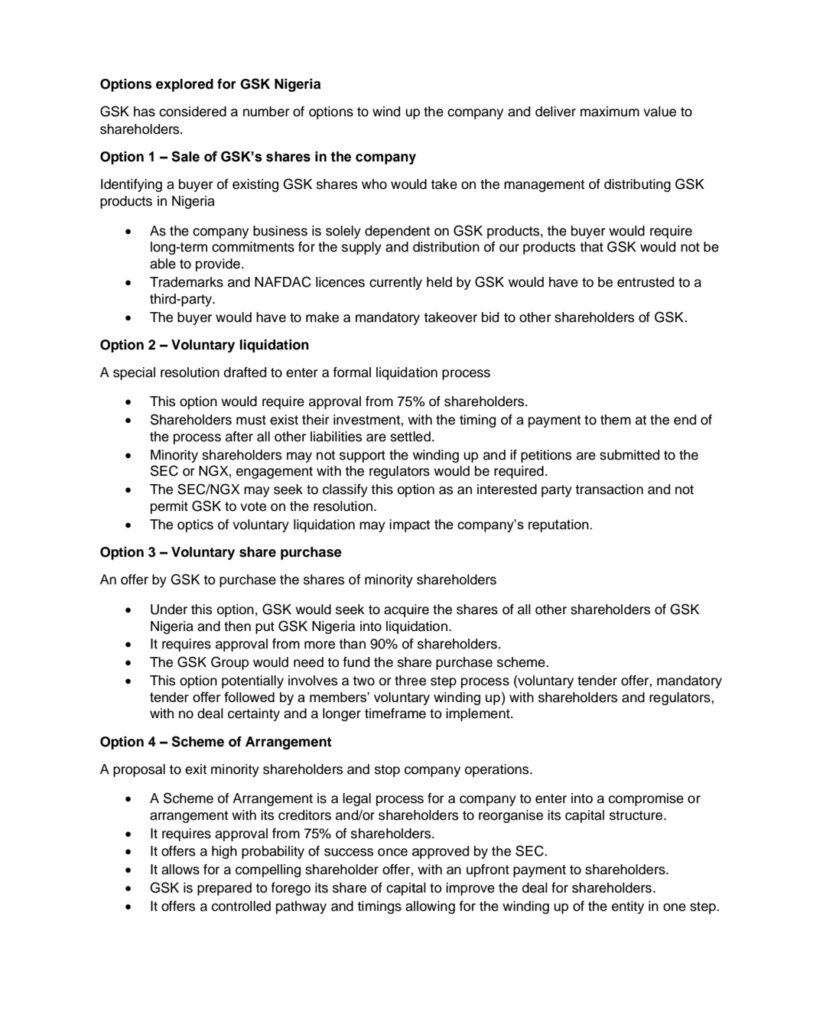

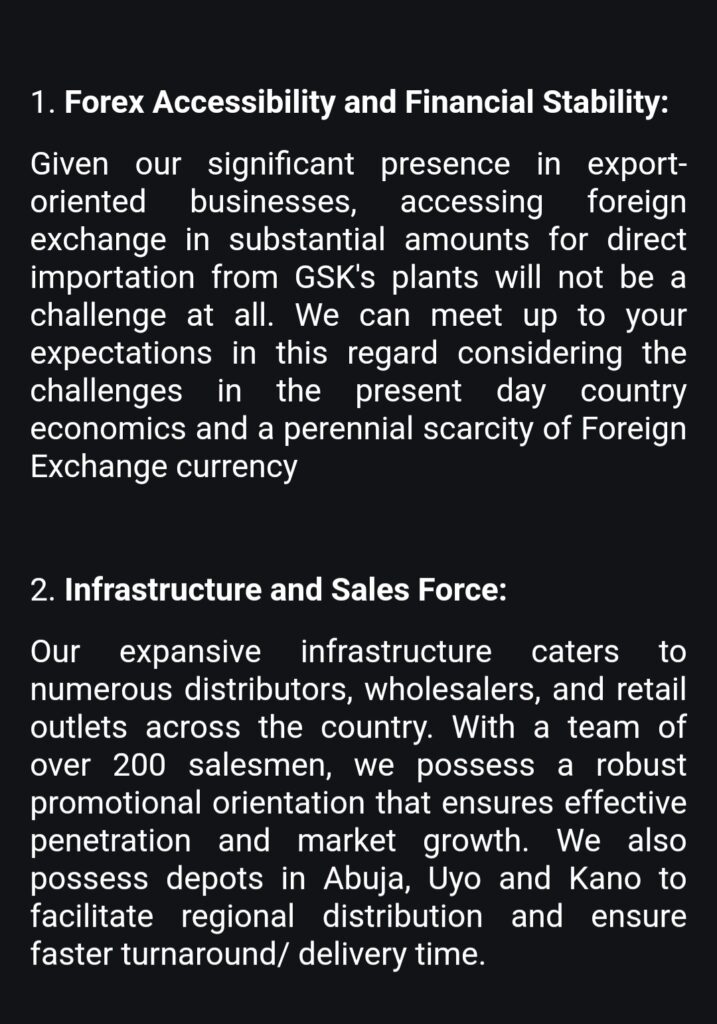

“Interestingly, CHI Pharmaceuticals Ltd. and a handful of other private equity companies, having noticed the trend of GSK UK shutting down companies in Africa, wrote the company, offering to buy its shares so that the continuous supply of drugs to Nigerians could be ensured,” said the third source.

“They also offered to assist with the provision of adequate forex to prevent the company from exiting Nigeria, but GSK rejected the offer.

“GSK UK’s ultimate plan was to change the model, shut down business and implement the distributor model in Nigeria. This was clearly at the detriment of the average patient, who constantly needs the company’s products to survive.”

WHEN THE BOARD MET ON THE ISSUE

When the board met again on the matter, some members raised concerns on the way the process was being managed by GSK. These board members felt they were being rushed into making a decision.

“They also felt all options of getting forex to ensure continued business in Nigeria had to be explored before the decision to wind down was taken,” said the source.

“GSK, however, insisted that exiting Nigeria was its best option.

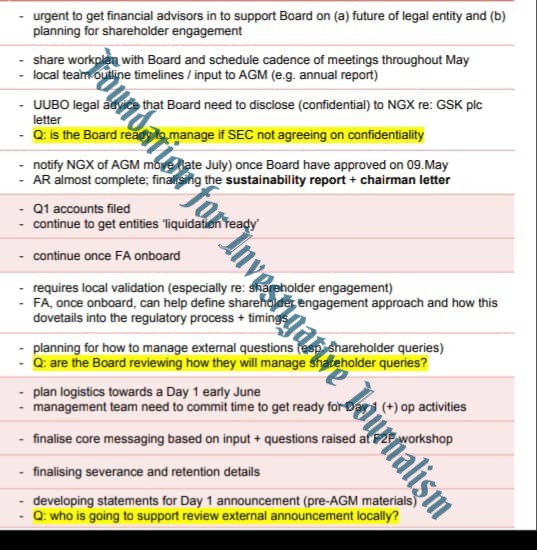

“At that point, the board members requested professional guidance, and GSK was quick to recommend Chapel Hill Denham (CHD), an investment management firm serving as GSK’s financial adviser, to them.

READ ALSO: To Accommodate ‘One More Passenger’, United Airlines Downgrades Nigerian Family From Business to Economy Class in the US

“This same CHD had been advising GSK UK on business decisions and matters since 2022. GSK UK manipulated the system by getting the board members to use the same executors who had been advising it in the past to reach a much desired decision on its exit plan.

“In the end, GSK, through CHD, got the board to take the exit request to the rest of the shareholders at an extraordinary annual general meeting.”

PROTESTS OVER GSK’S EXIT PLANS

Samuel Kuye, an experienced member of the board, sensed GSK UK’s move reeked of coercion and resigned his position in protest.

After Kuye’s resignation, GSK UK promptly appointed two of its employees as board members, and this resulted in the company having majority representation on the board.

In reaction to Kuye and other shareholder’s protests, GSK, through its communications and government affairs director, rebutted the claims and gave the same forex challenge excuse as the reason for the company’s exit.

AN EXTRAORDINARY MEETING WITH ALL GSK SHAREHOLDERS IN ATTENDANCE

A court-ordered extraordinary general meeting was subsequently held on December 5, 2023.

“At the meeting, the fact that multiple private equity companies approached GSK with offers to save the Nigerian business was never brought to the entire shareholders’ attention,” said the third source.

“The shareholders, while at the meeting, were also mildly threatened to take GSK’s monetary or risk an additional loss in their stocks’ value as the company would be forced to incur additional expenses while still running its business locally.

“Subsequently, the shareholders voted in favour of the exit, and they were settled at a premium of N17.42 for every share they held. The entire process ended up being in favour of GSK UK.”

READ ALSO: UK-Based Nigerian Student Cancelled Flight Over Change of School Resumption Date. Qatar Airways ‘Seized’ His 1m

TOPAZ DELIVERY AND ACTION PLAN

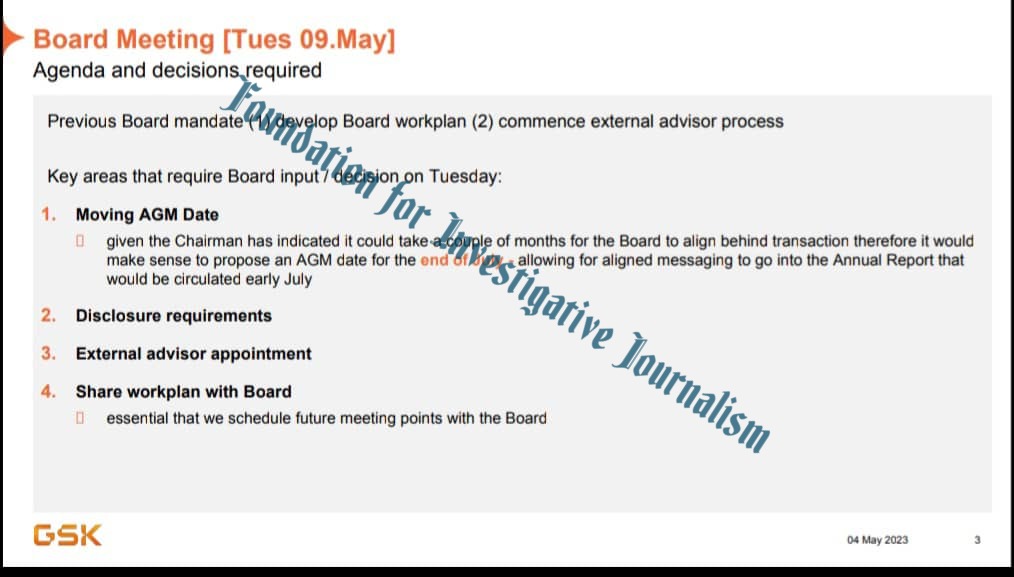

To ensure that the plan to exit Nigeria was duly executed, GSK came up with an internal action plan called the Topaz Delivery Plan in early 2023.

In the plan, it was stated that the annual general meeting (AGM) earlier scheduled for early July 2023 would have to be postponed to the end of the same month. The shift in date became necessary because GSK UK felt it could take a while before the entire GSK Nigeria board could be convinced or made to align with its exit plan.

Another strategy stated in the plan was to ensure that announcements were thoroughly reviewed before they were made public. It was also stated in the plan that messaging had to be spot on because shareholders might not be privileged to have full access to the entire transaction details.

Company directors’ remuneration and staff severance packages to be paid were also outlined in the plan.

“The truth is, the shift in date was GSK UK’s way of buying enough time that would enable it to work the board to submission,” said the third source.

“It was a way of getting the entire board to do its bidding.”

THE 2014 CHINA BRIBERY SCANDAL

Ironically, while GSK UK was taking baby steps aimed at exiting the Nigerian and African markets, the pharmaceutical giant was being investigated for bribing Chinese doctors and hospitals in order to have its products promoted in China.

In July 2013, the Chinese government first announced it was investigating the multinational for what it termed the biggest corruption scandal orchestrated by a foreign firm at the time.

The company was also accused of making an estimated $150 million in illegal profits through the scheme.

READ ALSO: INVESTIGATION: Farmer-Herder Clashes in Nasarawa Through the Eyes of the Victims

In September 2014, after a court in China found GSK UK guilty of bribery, the government of China ordered the firm to pay a $490 million fine.

The court also gave Mark Reilly, GSK’s former head of Chinese operations, a suspended three-year prison sentence. Apart from this, his deportation was also ordered.

Some other GSK executives were also handed suspended jail sentences by the court.

GSK would later publish a statement, apologising to the Chinese government and its people for its actions.

GSK’S EXIT TAKES ITS TOLL ON NIGERIAN PATIENTS

As of the first quarter of 2023, prior to GSK’s eventual exit announcement in August 2023, the pharmaceutical company’s products, like the Ventolin and Seretide inhalers, had already become scarce.

In 2022, the Ventolin inhaler used by asthmatic patients sold for between N2,500 and N4,000.

As of May 2023, however, the same product’s retail price had risen to as much as N9,000. This was because it had become scarce at pharmacies and other drug stores nationwide.

Seretide, a brand of inhaler used by patients whose attacks can no longer be controlled or tamed by Ventolin, sold for N6,000 as of the first quarter of 2022.

By May 2023, and because of its scarcity, the same inhaler sold for N30,000 at pharmacies and drug stores that had a few units in stock. By August of the same year, the price had increased to N40,000.

Seeing the desperation of asthmatic patients in ensuring they had access to the few brands of GSK inhalers in circulation, criminal syndicates profited from the situation and started selling unregistered and adulterated inhalers.

The development later forced NAFDAC to issue a public statement in January 2024, advising the public to be weary of such products during purchase.

At a point, the two products were no longer available, leaving patients to fight for their lives during asthma attacks. This left patients with no choice but to use alternative inhalers that have strong and harmful side effects.

“Technically, GSK put the lives of over 200 million Nigerians at risk for profit-making reasons,” the source said.

“Despite controlling 85 percent of the inhaler market in Nigeria, the company made sure the commodity became scarce during the period.

“You can imagine a company making bold plans of exiting the country since September 2022, and when they made their exit, questions were also never asked by the regulators. They did this without thinking of the patients who depended on their drugs.

“While GSK still had its presence in Nigeria, the cost of marketing its products was about 25 percent of its profit line.

“The 25 percent that would no longer be spent as a result of the exit automatically becomes an addition to the profit margin realised at the end of the business year.”

“GSK stands making about $30 million profit on a yearly basis from Nigeria, and without its presence in the country. That is clearly at the expense of the average patient.”

READ ALSO: How Retired AIG Solomon Olusegun Sacked 2 Kwara Policemen for Refusing to Implicate His Enemy

GSK RESPONDS

On June 26, GSK UK responded to an email sent by FIJ through Dan Smith, its global corporate media relations director.

The company began its response by citing forex paucity as the major reason it exited Nigeria.

“After extensive and constructive engagement with the board of GSK Consumer Nigeria about GSK’s strategic intent to transition the business model from GSK-controlled local operating companies to a third-party distribution model, the board decided to cease trading and ultimately recommended that shareholders vote in favour of the scheme, which was made possible with support from GSK,” the mail reads in part.

“All of the above information was clearly set out in a ‘Scheme of Arrangement’ that was shared with shareholders ahead of a shareholder vote to determine support for the proposal. On 5 December 2023, the shareholders returned near unanimous support for this scheme.

READ ALSO: Court Orders UBA To Pay N44m to Ex-Staff Forced Out of Office for Abiding by Procurement Ethics

“It’s worth noting that under the scheme, GSK shareholders received a total cash distribution of N17.42 for every share of GSK Consumer Nigeria they held and N11.16 billion in aggregate. This represented a 134 percent premium on the 90-day volume-weighted average price of the company’s shares as of the close of business on July 31, 2023. GSK did not take its share of the cash distribution and had taken no returns from the company since 2017.”

DISSECTING GSK’S VISIT TO THE BOARD CHAIRMAN

Since GSK UK failed to address the question posed to it on whether its officials first visited the chairman of the GSK Nigeria board in 2023 alone or not, FIJ consulted Abimbola Ojenike, its legal counsel and Managing Partner of Slingstone LP, on the legality of such moves.

“Management lobbying through the board chairman is not strictly a violation of corporate laws or the Companies and Allied Matters Act,” Ojenike said.

“While there may be implications for corporate governance practices or decision-making processes, no law is expressly breached by lobbying the board chairman.

“Ultimately, the board chairman doesn’t act alone, and management can’t validly bypass board approval regarding those reserved board matters. Playing the boardroom politics to consult with the chairman or board leadership can work out either way.

“It can facilitate and strengthen the quality of decision-making as the leadership is better informed. In the same way, it can provide the avenue for compromising the appropriate level of scrutiny that would have helped to prevent poor decision-making.

“The consideration is more nuanced and involves looking at the constitutive documents of the company to know if there are provisions on management-board relations and if any of those principles are violated by direct communication between the management and the board.

“It also depends on the underlying policy proposal that the management is lobbying the board leadership for. What is the management seeking to do, and what is the effect on shareholders, employees, the business environment and regulations? Those are some of the key questions in looking at the propriety of lobbying the chairman.”

On the allegation that GSK had a hand in the selection of CHD to achieve its exit plan, Ojenike said no clear rule has been violated.

“No law is violated by retaining the services of the same financial adviser if there are no breaches of fiduciary duties or any ethical consideration,” the lawyer told FIJ.

IMMENSE PROFIT FOR A FEW, AGONY FOR MANY

The part of the email that emphatically addressed the N11.16 billion payment (134 percent premium) the company made to its shareholders underscores the sources’ claims that GSK did not take the average Nigerian patient who needed its products for survival into consideration.

It also reflected a shrewd business decision that only profited a few businessmen and led to immense distress and agony for many Nigerian patients who depended on the company’s drugs and vaccines to survive. The company’s exit also led to a rise in the cost of drugs and vaccines, forcing patients to settle for inferior and harmful drugs.

More importantly, GSK failed to respond to the question raised on whether the forex shortage issue could have been resolved by way of raising fresh market capital (through accepting forex assistance from Chi Pharmaceuticals and other interested private equity companies).

Subscribe

Be the first to receive special investigative reports and features in your inbox.