Peter Ezeike, an Ecobank customer, has accused the bank of stealing N3,755,000 from his account between 2018 and 2019.

Ezeike explained that the money was stolen while he was away in the United Arabs Emirate (UAE). He left for the country in 2017 and only returned to Nigeria in 2021, when he got leave from his employers.

He told FIJ that all the transactions that occurred on his account between 2018 and 2019 were done in his name without his knowledge. He operates a savings account.

READ ALSO: After FIJ’s Story, Kuda Returns Ibadan Data Analyst’s Money

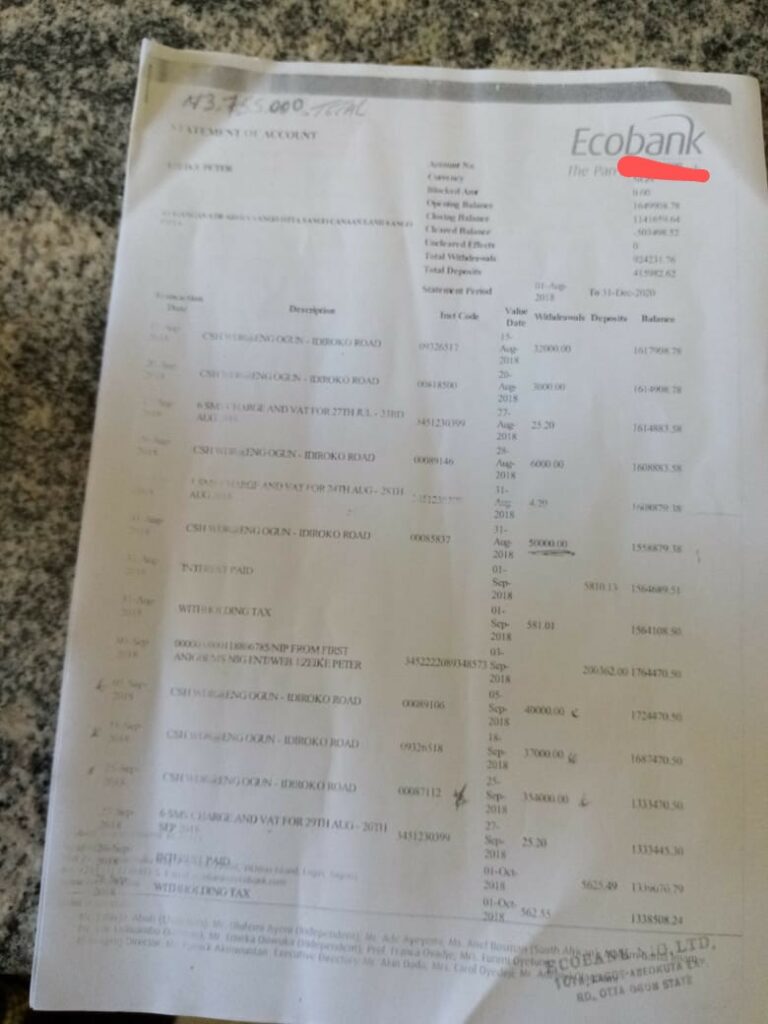

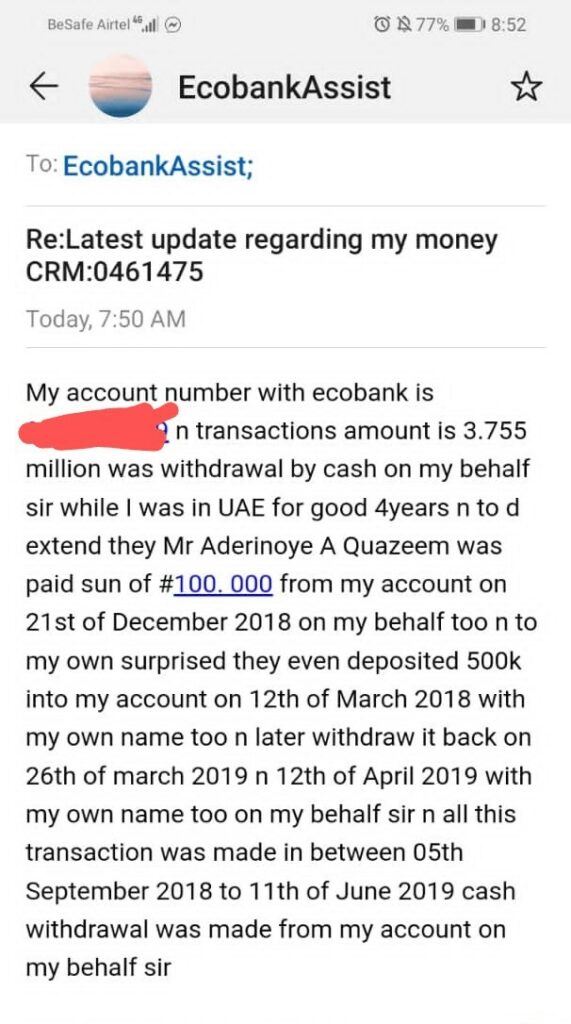

Only an account holder can authorise cash withdrawals from their account, but in Ezeike’s case, monies were deposited and cash withdrawals took place without his consent. Suspicious deposit transactions and cash withdrawals took place on his savings account at various times at a single branch without his approval. The transactions include payment of N100,000 to one Aderinoye A. Quazeem, whom he does not know.

HE SUSPECTS AN INSIDER

Ezeike told FIJ he had been operating his Ecobank account number before relocating to Dubai.

He further explained that before he left Nigeria, he regularly met one Ibrahim Akeyan, a staffer of the bank at the time, with whom he usually left money anytime he was unable to wait in a queue to deposit into his account.

“Mr. Ibrahim Akeyan was an employee of Ecobank at its Sango Ota branch in Ogun State. He was a regular face. Several times I would leave deposit money with him if I was unable to join a queue for some reason. We related freely and he knew my account details. There was never a problem then,” the Dubai returnee said.

“He is the person I suspect had tampered with my account due to that relationship I had with him. Some events that played out after I reported the missing money to the bank further reinforced my suspicion against him and even the bank itself.”

FIJ contacted Ibrahim via a phone call on November 20 for his reaction. He said he could not recall knowing Ezeike because he dealt with several customers. “I don’t know the person. I dealt with many customers and I cannot remember the name you are mentioning. The customer should approach the bank for whatever issues they have. I handed over properly before exiting the bank, and if there are questions for me to answer, it is the bank that will invite or call me.”

Ezeike was aware that he would return to Nigeria someday and would need some money to fall back on. Therefore, he was saving money in the account from his earnings in Dubai.

The Ogun State resident came back to the country in 2021 and went to the bank to carry out a transaction on his account. He was, however, shocked to know that his balance was insufficient. This made him to apply for his statement of account, which showed that he had less than N400,000.

SERIES OF UNAUTHORISED WITHDRAWALS

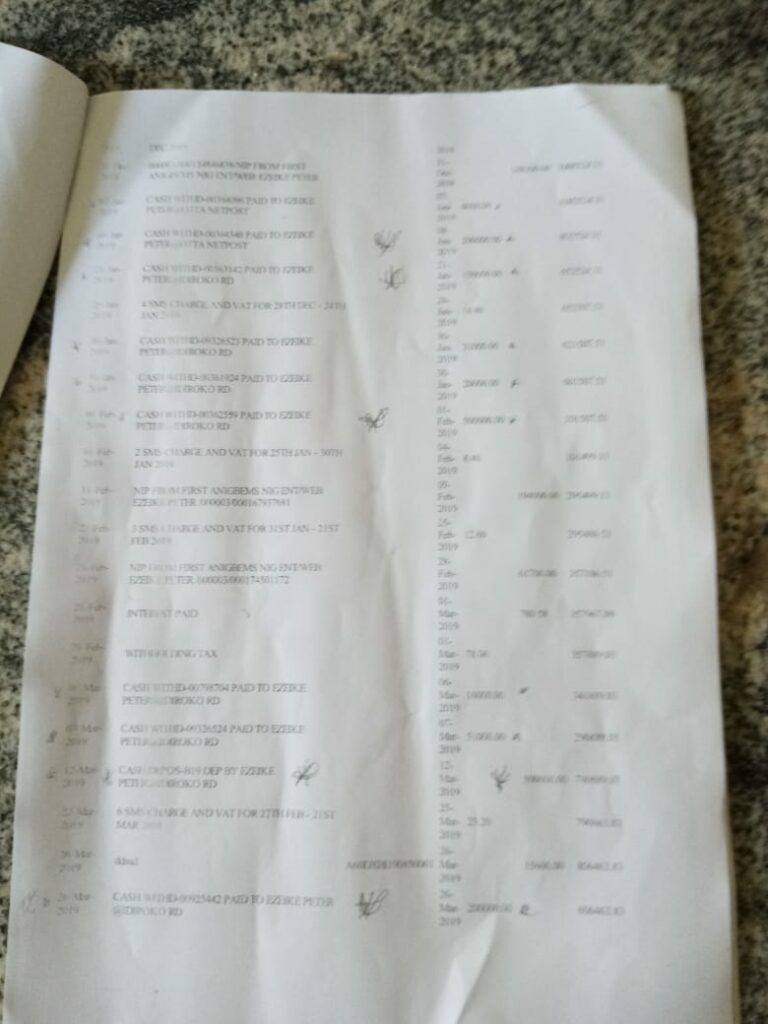

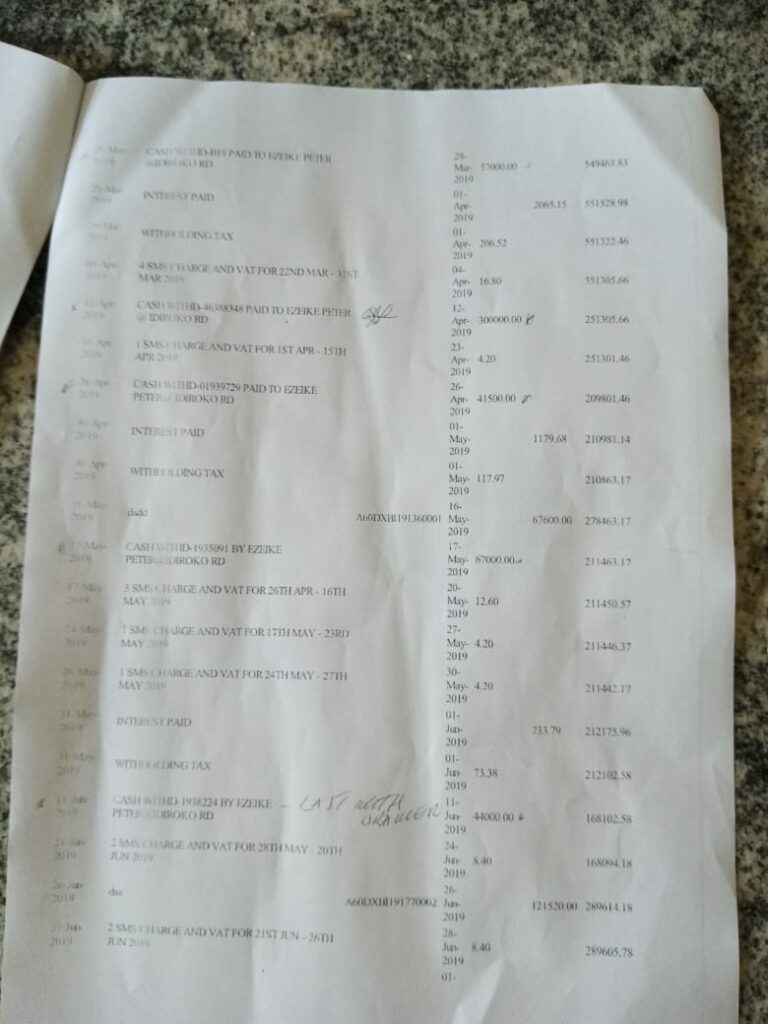

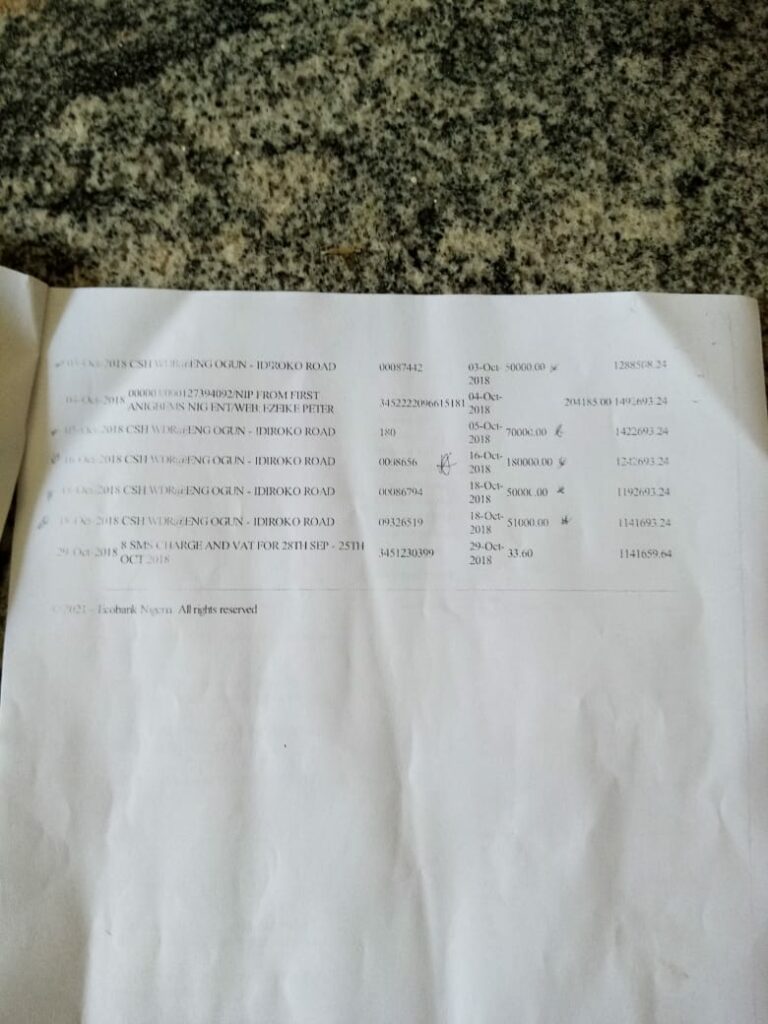

His statement of account, which covers the period between November 1, 2018, and March 30, 2021, details how the missing N3,755,000 was removed in batches all in his name. The transaction descriptions show that the monies were withdrawn in cash only from the Idi-Iroko branch of the bank.

FIJ also learned that some N500,000 was deposited into the same account and was subsequently taken out in his name and without his knowledge.

Peter Ezeike’s Ecobank statement of account

We asked Ezeike to apply for another statement of account from the bank because some parts of the one in his possession had become unclear. He was at the bank’s branch at Redemption Camp of the Redeemed Christian Church of God on November 22 for that purpose, but the bank official who attended to him said his account had been blocked and the request could not be processed.

BANK’S INVESTIGATION

The accused Ecobank branch attempted to find out how these transactions took place and possibly return the customer’s money, but nothing has happened yet.

Ezeike also stated that when he learned of the suspicious transactions, he approached Aderemi Adeleke, the branch’s customer service manager; and Olajide Folake, the branch manager, for a thorough investigation.

The bankers asked him if Ibrahim, whom he suspects, was aware of his presence in Nigeria and he answered in the negative. The officials got Ezeike’s contact information, particularly his new Nigerian phone number, in case they wanted to give him feedback.

Ibrahim surprisingly phoned Ezeike on the evening of that day on his new phone number. The customer was agitated and ended the call to inquire from the customer service manager how Ibrahim got his number. Ezeike was told that it was the bank who informed Ibrahim of the development and gave him the phone number.

“I felt very sad. I asked him why would they release my phone number to Ibrahim or even any other person without my permission. They told me they had to let him know of the development before proceeding to arrest him. Even if they wanted to arrest him, what is the connection between that and the release of my phone number to him?

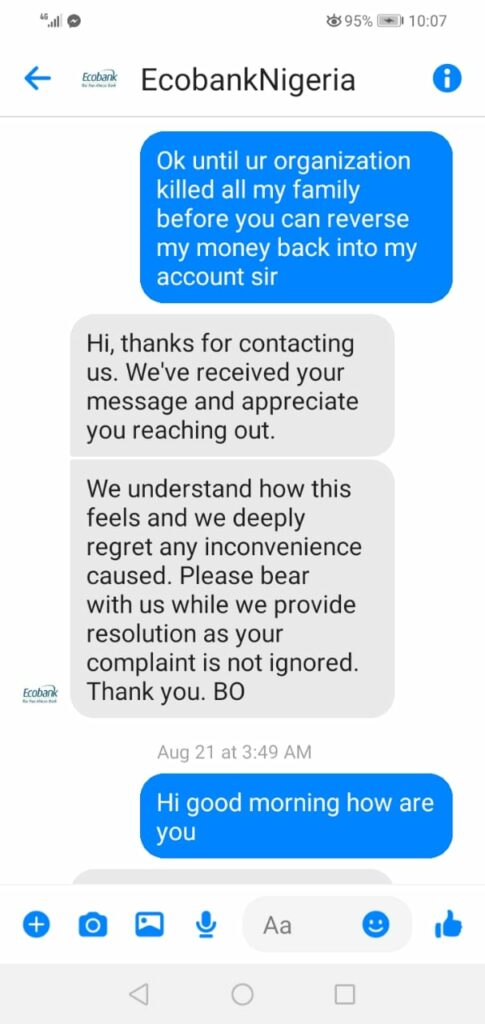

“That moment dampened my spirit. They have neither arrested him nor made their findings known to me till this moment. I have messaged them many times without a clear information.”

Thereafter, the bank arranged four different meetings over the matter. Ibrahim attended none of it despite being informed and invited by the bank.

The issue got to the head office’s attention and a virtual meeting was scheduled. The bank informed Ibrahim, but he failed to attend. The head office collected all the documents they required from the customer to aid their investigation.

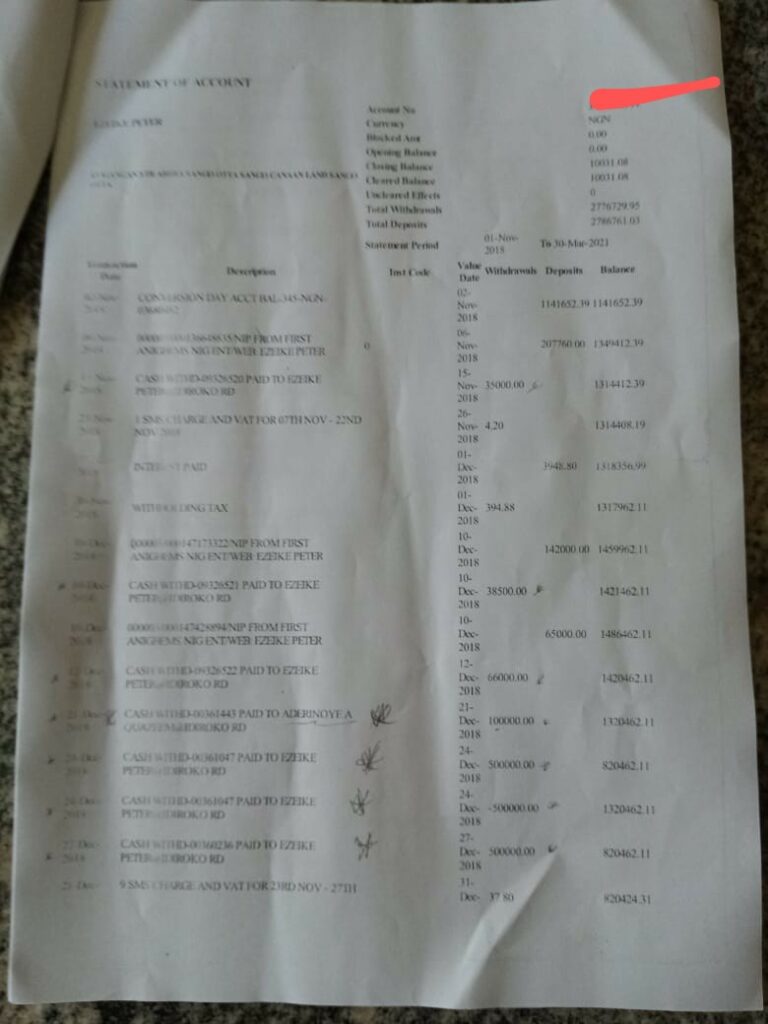

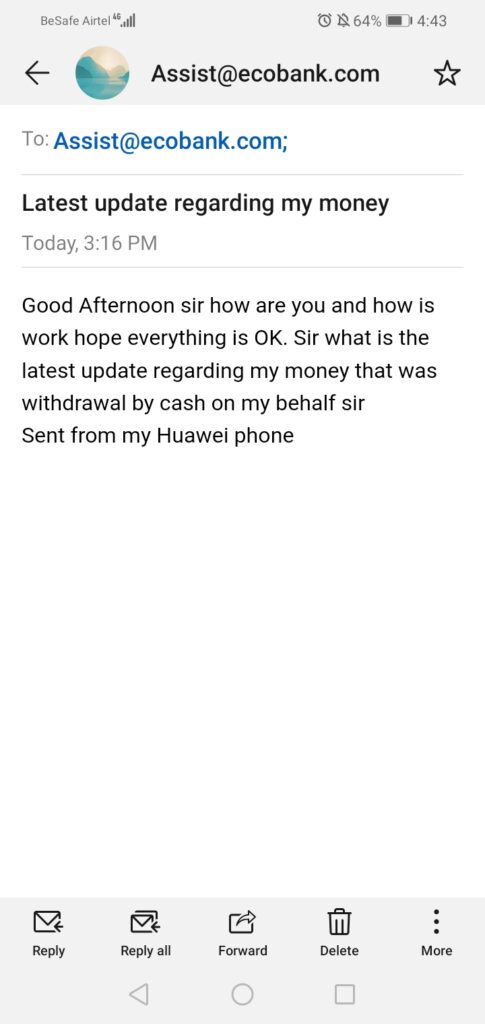

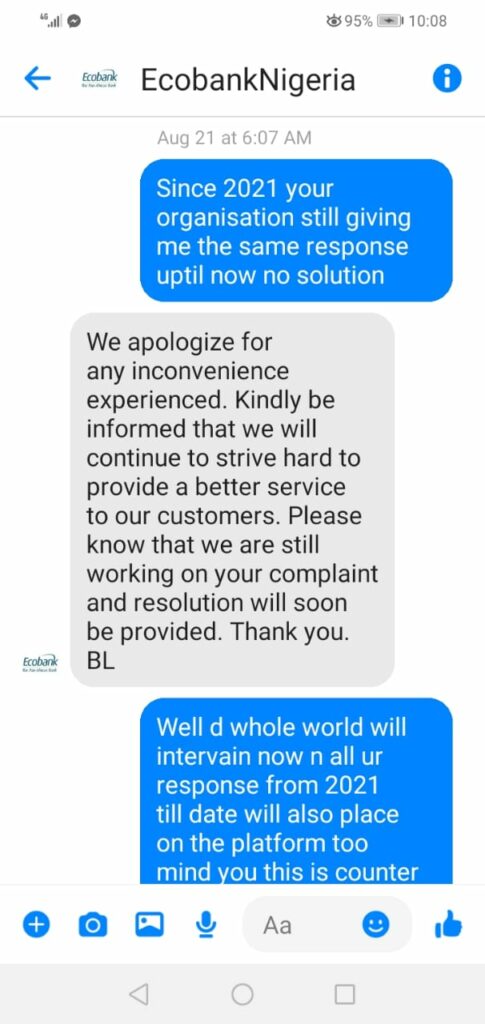

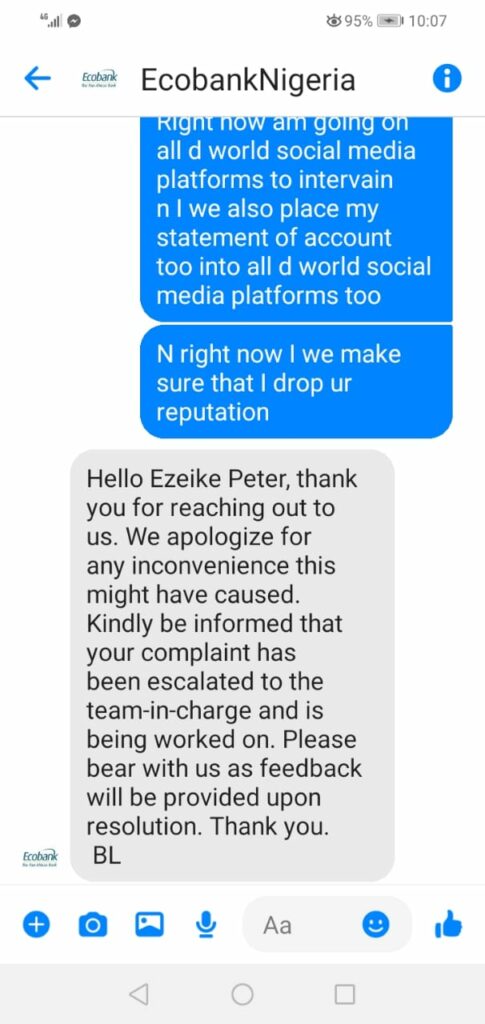

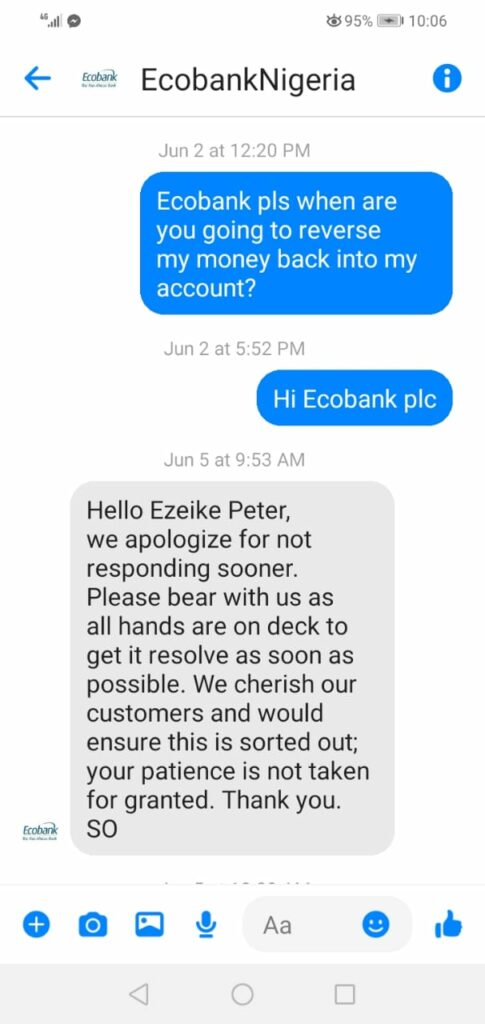

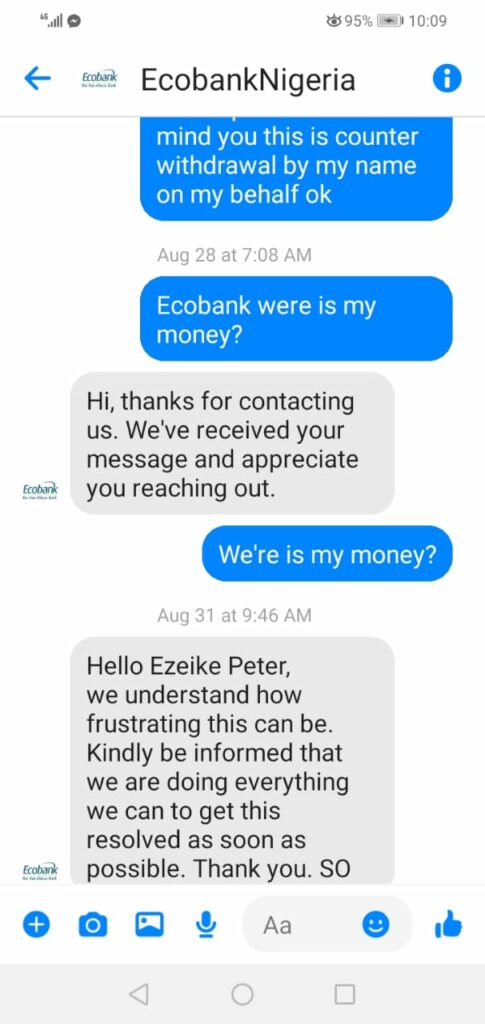

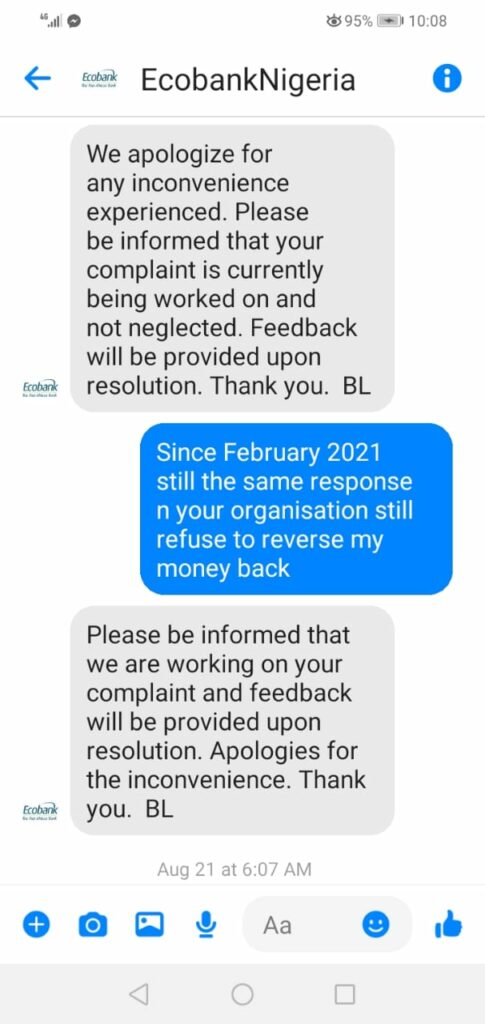

Chats between Ezeike and the bank

More than two years after, the bank has not come up with their findings. We obtained evidence of email communication and social media chats Ezeike had with the bank, showing the bank kept promising to resolve the complaint.

The bank had not responded to an FIJ’s email at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.