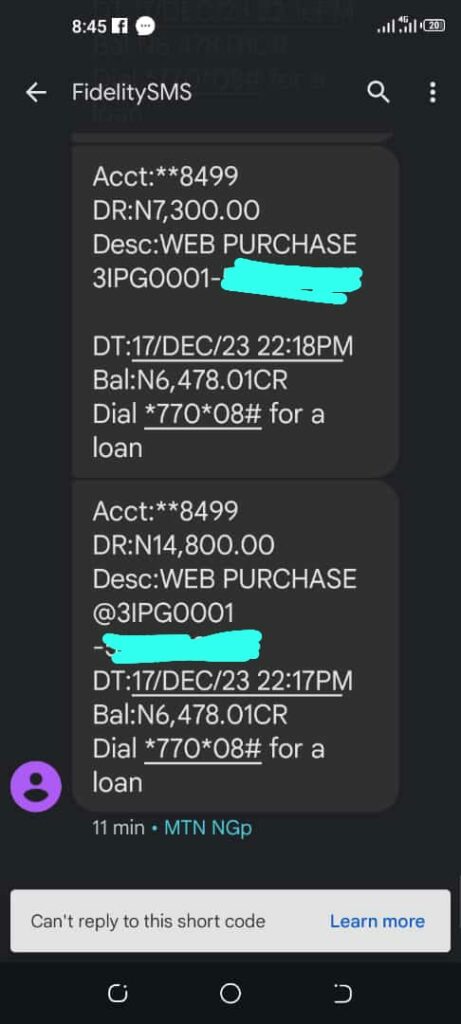

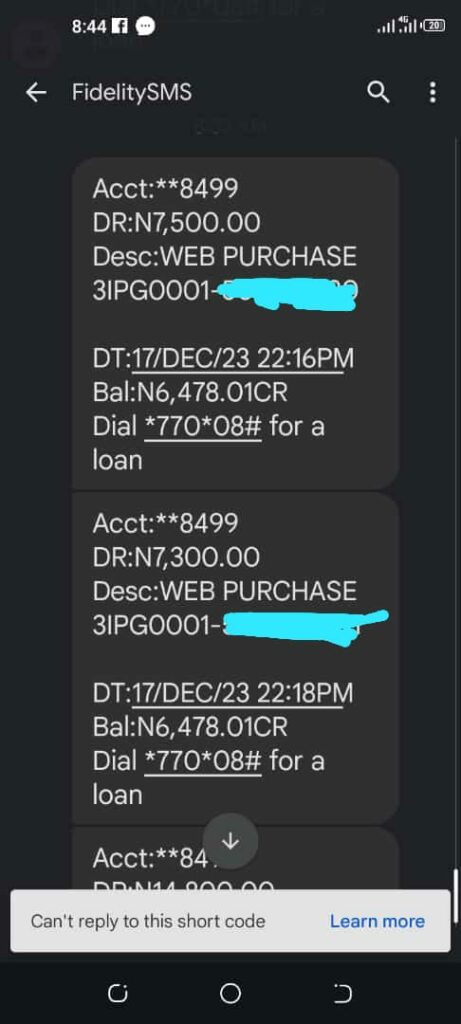

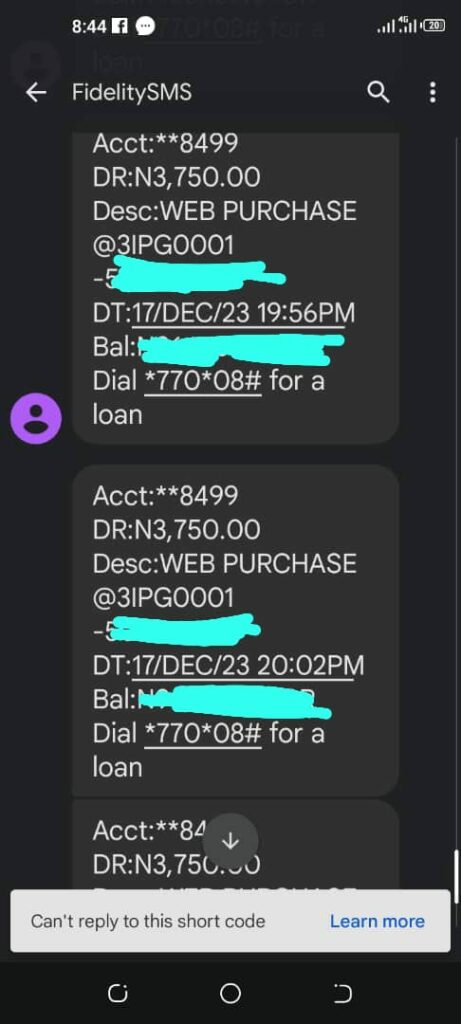

Daniel Buraimo (not real name), an Ogun State-based businessman, has narrated how over N45,000 vanished from his Fidelity Bank account without his authorisation.

Buraimo told FIJ that the incident happened on the evening of December 17.

“I deal in aluminium sales in Abeokuta,” Buraimo said.

“I was in my living room when I started receiving strange debit alerts on my phone. Someone was transacting on my Fidelity Bank corporate account without my authorisation. The incident started around 7 pm.

“I was surprised that I could receive several debit alerts for the transactions I never did. I kept receiving messages showing debits of N7,000, N6,000 and N14,000 on my phone that night. They were mostly web-purchase transactions.

READ ALSO: Lagos Electrician Can’t Explain How Client’s N800,000 Left His Zenith Bank Account

“Because it was a Sunday, I could not really do much. So, in the end, and to stop the fraudsters from draining the entire money I had in the account, I quickly transferred what was left to another account.”

Buraimo said he subsequently went to a Fidelity Bank branch in Omida, Oke-Ilewo, Abeokuta, to lodge a complaint the following day and was promised by the officials he spoke with that the matter would be looked into.

“At first, they told me that the fraud occurred on my account because I had compromised my debit card details,” Buraimo said.

“I immediately refuted the claim, making them understand that my debit card was always with me. I don’t even share my debit card or account details with anyone.

“I also only make withdrawals at ATMs myself. I don’t send anyone to make withdrawals or any other transaction on the account or on my behalf. There was no way I could have compromised the account details.

READ ALSO: GTB Places Restriction on Customer’s Accounts Over N586,000 Fraud He Self-Reported

“When I said this, they told me the matter would be looked into. Since that Monday, however, I have not heard from Fidelity Bank on the matter.

“Times are hard, people struggle to make ends meet, and it is not right or fair to see the money you have suffered for stolen right before your eyes.”

FIJ sent a mail to Fidelity Bank’s customer care desk for comments on Thursday, but it had not been responded to at press time.

Subscribe

Be the first to receive special investigative reports and features in your inbox.