Nnamdi Ndefo, a safety services provider, has narrated to FIJ how Stanbic IBTC failed to reverse N91,600, and N10,200 erroneous deductions from his account following failed cash withdrawals from POS agents in 2020 and July 2022.

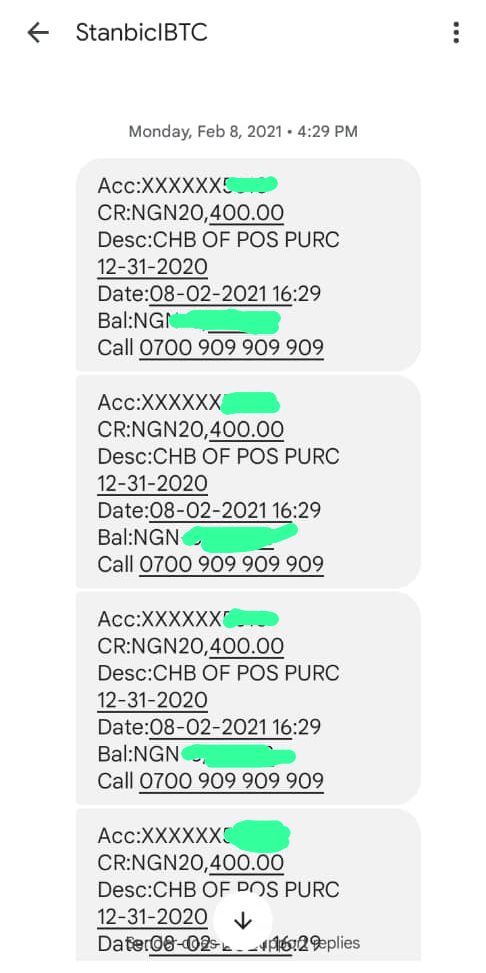

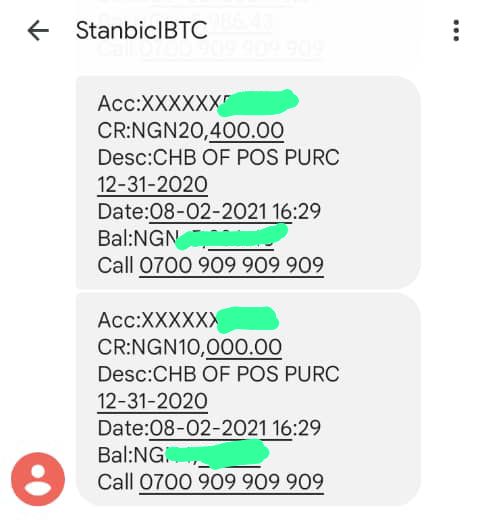

Ndefo said he tried to make a withdrawal via an Opay POS on December 31, 2020, and was debited N20,400 four times in a row and then N10,000.

According to him, the POS agent asked him to wait 24 hours for his transaction to be reversed, but after waiting 24 hours with no response, he complained to his bank.

READ ALSO: Customer’s N900,000 Disappears While Activating GTB Mobile Application

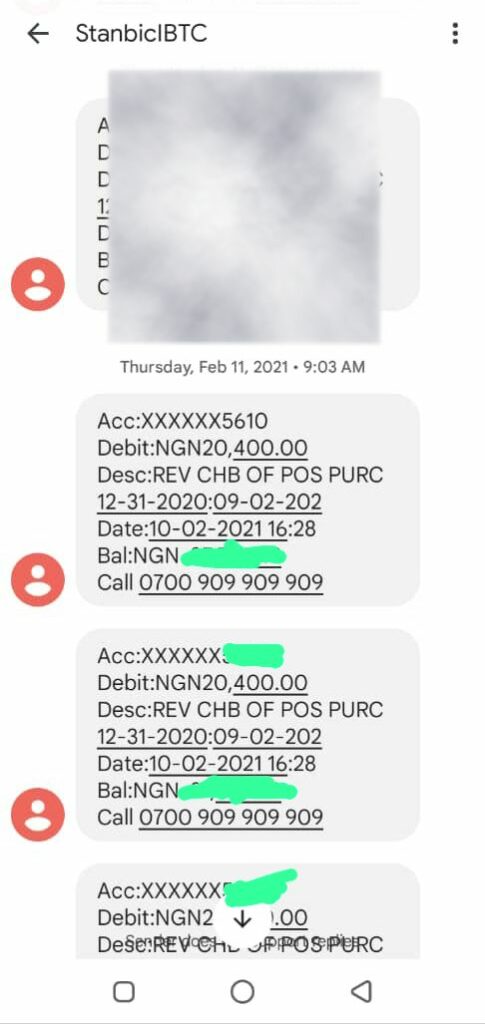

Ndefo said his money was reversed on February 8, 2021, only to be deducted again three days later, on February 11.

Ndefo stated that he had contacted both Stanbic IBTC and the Opay agent with whom he conducted the transaction, as well as reported the incident to the Opay office, but had received no positive response.

He said the time the money was debited coincided with when he was diagnosed with a kidney ailment, and so he could not visit the bank regularly to follow up but relied mainly on contacting customer service to help resolve the issue.

Ndefo said he was able to visit the bank months later and they promised they would refund and contact him but failed.

READ ALSO: In One Month, Ecobank Customer Loses N324,000 to Unauthorised Transactions

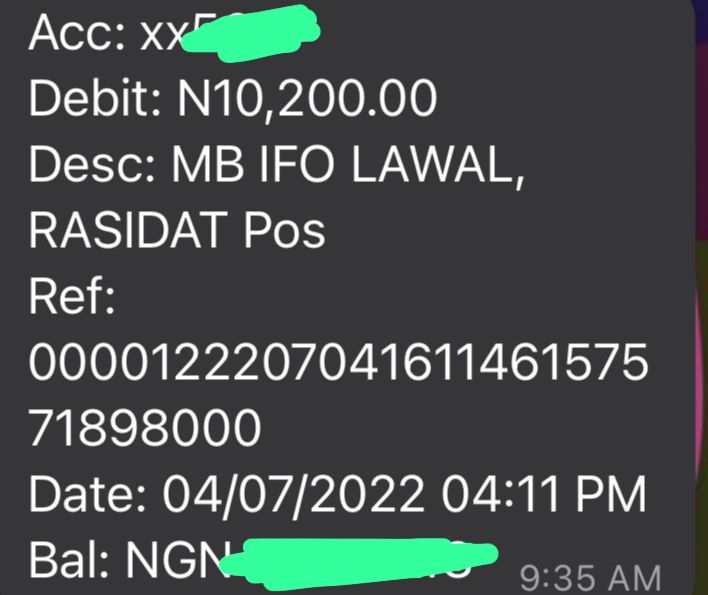

He said in July of this year, he was debited another N10,200 following a declined POS transaction, and despite several attempts to call the bank’s attention to it, there had been no response.

When FIJ contacted Stanbic IBTC for comments via their support Twitter handle, they stated that they do not respond to third party requests and advised that the source contact them directly through their customer service lines.

Subscribe

Be the first to receive special investigative reports and features in your inbox.