In January, Jacob Adeogun (not real name) borrowed N12,000 from 9Cash, a quick loan company in Nigeria, to purchase drugs for his ailing mother.

Jacob told FIJ that his intention was to repay the loan within seven days, but, unfortunately, the unexpected happened. He lost his mum to the illness.

“The sad event overtook so many things and I totally forgot the repayment I was supposed to make during that period,” Adeogun told FIJ.

“The day after we buried my mum, I was in the living room when my sister rushed in to show me the message she had received from 9cash.”

READ ALSO: After Damaging Text From LCredit, Aggrieved Borrower Vows Never to Repay Loan

The message Adeogun’s sister had received was one describing him as a chronic debtor and criminal.

“Unfortunately, virtually all the contacts on my phone received the same message as well. It was a terrible period for me. I had to explain to several people that I wasn’t a chronic debtor and criminal,” Adeogun said.

After the incident, the 29-year-old factory worker vowed never to make any repayment to the company.

“Since then, they have been sending me many messages, threatening me with arrests and so on. But really, deep within me, they have done their worst by sending messages to all my contacts. What can be more embarrassing than that?

READ ALSO: Quick Loan Company Announces Customer’s Obituary for Missing Payment Deadline

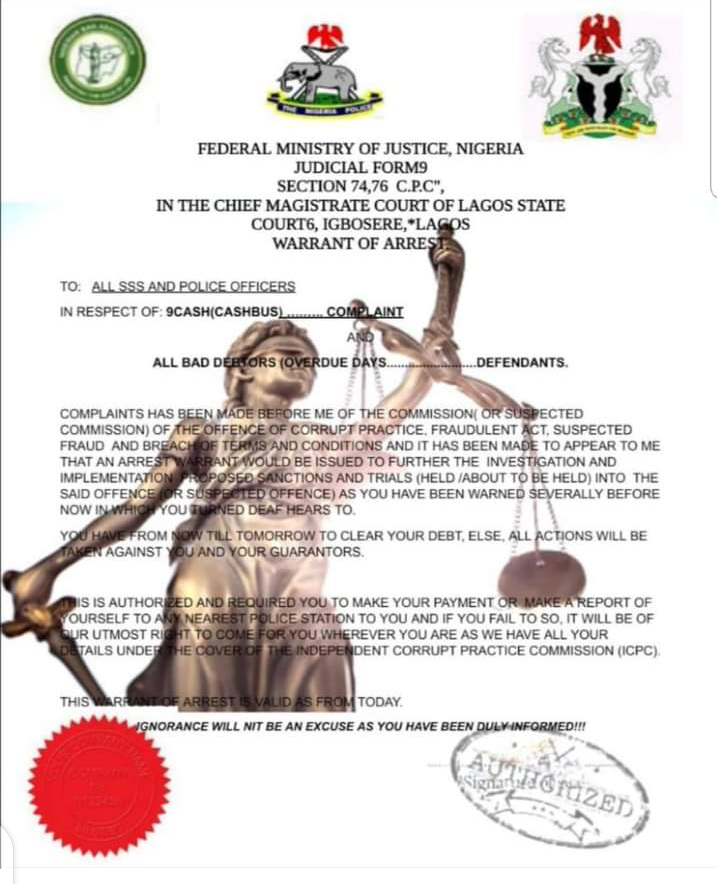

“Last week, I was trying to access messages on WhatsApp when I discovered that a strange number had sent me a fake arrest warrant. I tried calling the number back but it was not reachable,” he said.

“The warrant had no name, signature and date. I immediately knew it was fake and burst into laughter. This people will stop at nothing in their bid to continue intimidating people. I swear I will never repay that debt.”

On November 15, 2021, the Federal Competition and Consumer Protection Commission (FCCPC) issued a statement announcing the beginning of an investigation into rights violations in the money-lending industry.

READ ALSO: ‘He Is HIV Positive’ — Quick Loan Company’s Message to Defaulting Customer’s Contacts

This came after the National Information Technology Development Agency (NITDA) fined Sokoloan, another moneylender, for breaching its customers’ data privacy, an action that clearly violates Article 2.2 of the Nigeria Data Protection Regulation (NDPR), which bans illegal data sharing with third parties.

Despite the fines, sanctions and the shutdown of some of these firms, many of them have continued to devise new means of harassing their debtors.

FIJ made several calls to the service line of 9cash, but they were not answered. A text message sent to the company was also not responded to.

Subscribe

Be the first to receive special investigative reports and features in your inbox.